Key Points

The price of Bitcoin is going down and it's simultaneously getting harder to mine, which doubly impacts Bitcoin mining profitability.

Bitcoin miners are spending money to increase their computing power as quickly as possible.

Despite their similarities, each of these companies is unique and needs to be considered on an individual basis.

What happened

Russia may be considering a ban on cryptocurrencies, which might be negatively impacting the price of the world's largest cryptocurrency by market capitalization: Bitcoin. And while investors in the Western Hemisphere were sleeping last night, stocks in Asia were falling, which could have also influenced cryptocurrencies. For its part, Bitcoin is down about 11% over the past 24 hours, as of 2:45 p.m. ET. And it's also down roughly 45% from its all-time high in November.

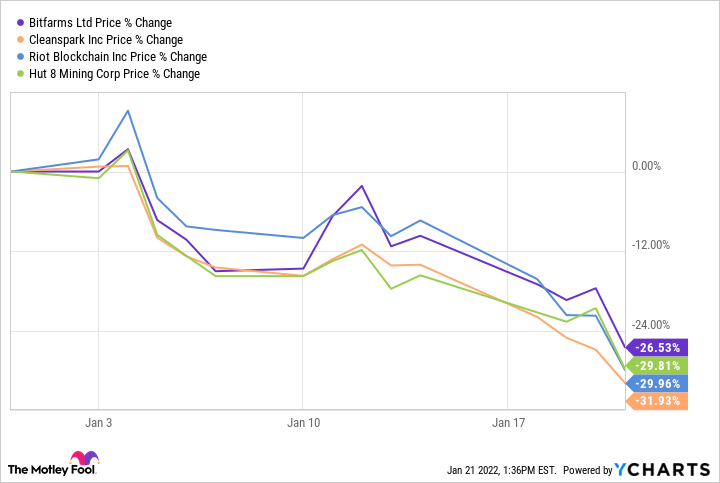

This downward trend isn't good for Bitcoin miners like Bitfarms (NASDAQ:BITF), Hut 8 Mining (NASDAQ:HUT), Riot Blockchain (NASDAQ:RIOT), and CleanSpark (NASDAQ:CLSK). As of this writing, these stocks were down 12%, 12%, 12%, and 7% respectively.

So what

It's hard to pin down exactly what's causing the cryptocurrency crash today -- there are multiple factors likely contributing to it. Investors constantly fear that greater regulatory scrutiny from world governments will impede long-term adoption. China has already cracked down on cryptocurrencies and investors are understandably worried Russia could go the same route. This is because Russia's central bank suggested banning all cryptocurrencies in a presentation yesterday.

Growth investments have also been taking it on the chin lately. While stocks and cryptocurrencies differ fundamentally, it appears many people buy cryptocurrencies for the same reason they buy stocks: They're not so much interested in the underlying utility of the tokens, but rather they expect them to go up in value. But inflation concerns and interest rate hikes are in the news and investors are selling more speculative assets, including Bitcoin, as a result.

Interestingly, the total hash rate for the Bitcoin network is hitting an all-time high, which creates an even more unfavorable environment for Bitcoin miners. According to Blockchain.com, the seven-day average for the total hash rate is over 198 million terahashes per second (TH/s), up from an average of around 170 million TH/s to start the year.

The hash rate measures the computing power of the Bitcoin network. The higher the hash rate, the higher the difficulty for miners. In simple terms, you mine more Bitcoin by supplying more of the network's hash rate.

Therefore, there are two factors hurting Bitcoin mining profitability so far in 2022. First, the price of Bitcoin is dropping so the value of what's being mined is decreasing. Second, Bitcoin is getting harder to mine because the hash rate is increasing. To offset the negative impact of the hash rate increase, you have to buy more equipment. If you don't, you'll have to be content with mining fewer bitcoins.

Now what

It's safe to say that Bitfarms, Riot Blockchain, Hut 8, and CleanSpark are not content with mining fewer bitcoins. For evidence, consider that all of these companies are increasing their hash rates:

Moreover, consider that all of these companies expect the price of Bitcoin to start going back up, as evidenced by the number of bitcoins each company has on its balance sheet:

CleanSpark holds far fewer bitcoins than the other miners we're looking at here. But it's interesting to note that the company periodically sells bitcoins to fund operations and growth -- it sold over 900 in 2021. This strategy is in clear contrast to other miners, especially Bitfarms. In addition to what it continues to mine, Bitfarms purchased 1,000 bitcoins for over $43,000 each during the first week of this year. Therefore, Bitfarms is already down substantially on this investment. By contrast, CleanSpark sold 414 bitcoins in December alone for almost $50,000 each. For now, it looks like CleanSpark made the better choice.

I'm highlighting these differences so that investors realize the need to be discerning when it comes to bitcoin mining stocks -- each company is unique. Bitfarms is both mining and buying bitcoins. Riot Blockchain is mining and holding. And CleanSpark is mining and selling as necessary to fund operations.

Finally, Hut 8 is actually diversifying away from mining. On Thursday the company announced it was acquiring a data center business called TeraGo. As Hut 8's CEO Jaime Leverton pointed out in the official press release, TeraGo is fundamentally "uncorrelated to digital asset mining." And this diversification could help smooth out some volatility in the cryptocurrency space for Hut 8 going forward.

By Jon Quast

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!