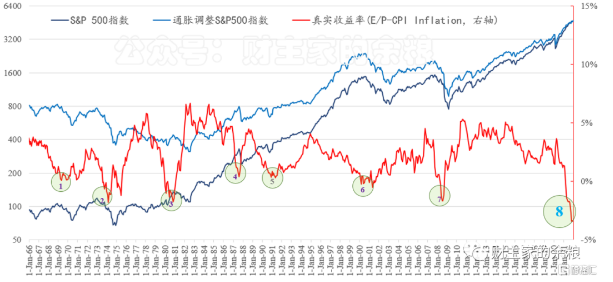

Looking at this chart, in the past half a century or so, the true return of U.S. stocks represented by the S&P 500 index (E/P minus CPI Inflation Rate), whenever it approaches 0 and then reaches a negative value, it usually Brings an in-depth adjustment of U.S. stocks.

1) In May 1969, the true yield of U.S. stocks TTM (rolling 12 months) reached the lowest point of 0.07% in 20 years, which was close to zero, which subsequently triggered a sharp drop in U.S. stocks;

2) In August 1973, the real return on US stocks TTM entered a negative range, reaching an extreme value of -0.65% after 2 months in October. Although US stocks had been adjusted slightly in the early stage, they really began to plummet in October 1973 ;

3) At the beginning of 1980, the real yield of U.S. stocks TTM entered a negative range, reaching the extreme value of -1.77% in November 1980, and U.S. stocks began to plummet from this month;

4) In August 1987, the real return on US stocks TTM reached the lowest value of 0.39% in 5 years. Less than 2 months later, US stocks suffered a Black Monday and plunged by 20%;

5) In December 1990, the lowest value of U.S. stock yields reached 0.38%, but it did not trigger an adjustment in U.S. stocks. This was the only time the true yield of U.S. stocks approached zero, but it did not trigger a sharp drop in U.S. stocks;

6) In March 2000, the real return on US stocks TTM reached the 12-year low of -0.23%, and the Nasdaq technology stocks collapsed that month;

7) In July 2008, the real return on US stocks TTM reached the lowest value of -1.66% in 28 years. Two months later, in September 2008, Lehman Brothers collapsed and US stocks began to plummet;

8) In April 2021, after 12 years, the real return on US stocks TTM entered the negative range again, and the negative value gradually deepened until it became -3.4% in November 2021, which was the lowest value in 74 years since 1947— -But the wonderful thing is that the US stock market has basically remained at a high level in the past few months, and there has been no obvious adjustment.

Since the end of the Second World War, every time U.S. stocks have risen for a long period of time, when their true yields have touched the negative range and gradually deepened, it will inevitably bring about a deeper adjustment, such as in 1973, 1980, and 2000. In 2008 and 2008, in particular, after the true rate of return hit an extremely negative value, almost within three months, U.S. stocks will inevitably undergo an adjustment.

If the true yield of US stocks is only close to 0 but has not fallen below, and there have been substantial adjustments not long before (for example, in 1990, the US stocks had just undergone an adjustment in 1987, and in 1975 they had just experienced a sharp drop in 1974. …), and the real rate of return quickly rebounds after it hits near 0 (inflation is controlled, or the yield of U.S. stocks rises sharply), then U.S. stocks may not experience a deep decline.

Since April 2021, the true yield of U.S. stocks has entered a negative range and has been deepening, but U.S. stocks have not undergone any decent adjustments. I personally guess that the reason may be that there is no greater capacity and greater certainty than U.S. stocks. A broad category of assets with better returns.

For example, in addition to the stock market, the other largest dollar financial asset is the U.S. Treasury bond, but if calculated according to the current inflation rate, in November, the real yield of the 10-year U.S. Treasury bond is -5.3%. Comparing the two, it seems that stock market returns are better.

This is probably the only reason the US stock market is strong.

The problem is that according to the market’s expected earnings per share (Forward EPS) for the U.S. stocks in the next one year, it is unlikely that there will be a jump like that in 2021 compared to 2020. In this case, if the U.S. inflation data cannot be as large as possible If it lowers, the US stock market's sharp decline is likely to be on its way.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!