What is cryptocurrency and how does it work?

Physical tokens such as bank notes, shells and gold coins have been used as a source of payment for ages. However, Satoshi Nakamoto introduced the world's first cryptocurrency called Bitcoin (BTC), a peer-to-peer electronic cash system based on cryptographic proof to allow network participants to interact directly without the need for a trustworthy third party, in October 2008, a few weeks after the Emergency Economic Stabilization Act saved the U.S. financial system from collapse.

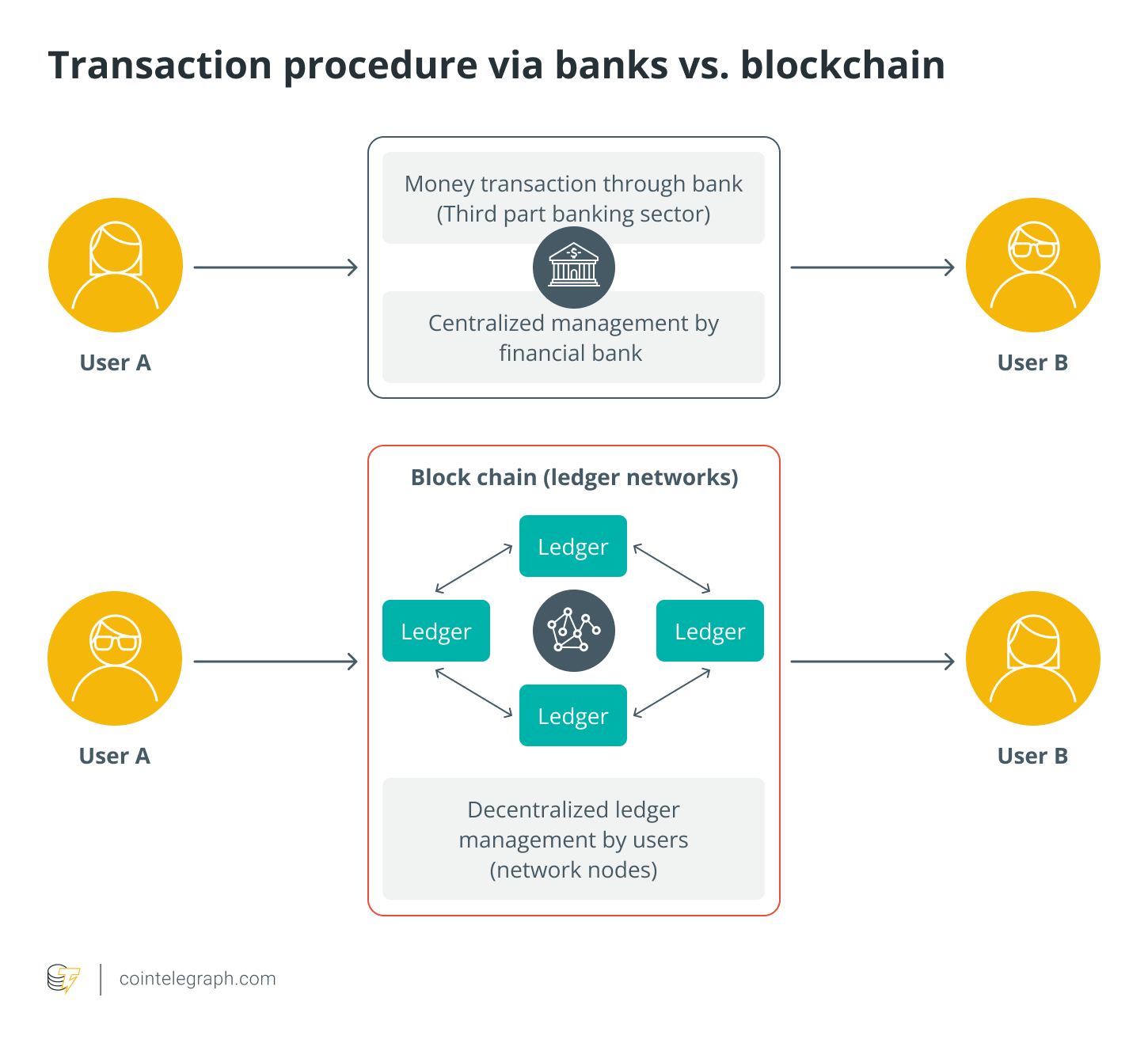

For the first time, money could be moved between two distant, skeptical persons without using an intermediary safely, thanks to Bitcoin. For example, any network participant might use the Bitcoin blockchain to validate and settle cryptocurrency transactions inexpensively due to a clever combination of cryptography.

In this article, let's explore the benefits of using cryptocurrencies and find answers to the most frequently asked questions, including What problem does cryptocurrency solve? Will cryptocurrency replace fiat money? and Is cryptocurrency a good investment?

What is the main purpose of cryptocurrency?

Cryptography is used to create a cryptocurrency, and digital currencies are protected by mathematics, not by individuals or a trust. But what is the main purpose of cryptocurrencies? Keep reading to find out!

Now, let's understand why we need cryptocurrencies. Debt is what creates the fiat money in your checking account; thus, the numbers you see on your ledger are nothing but liabilities. It is a promissory note system. However, debts are not represented by cryptocurrencies. Instead, cryptocurrencies merely act as their own representative.

Related: What is cryptocurrency? A beginner's guide to digital currency

Cryptocurrencies aim to restrict the power and responsibility of one's funds to the owners. Hence, Bitcoin, a permissionless, irreversible and pseudonymous form of payment, is an attack on banks and governments' control over their citizens' financial activities. Moreover, different cryptocurrencies have distinct features, such as Dash (DASH), a decentralized, privacy-focused digital currency that allows for quick transactions. It helps you keep your funds private while making transactions that don't require you to wait, such as cash transactions.

Another example is Monero (XMR), which is an untraceable, safe and private cryptocurrency. It's open-source software that anyone can use. You are your own bank with Monero, your finances are under your control and responsibility, and your accounts and transactions are kept confidential from prying eyes.

If you still wonder whether cryptocurrency is needed, think of the times when the global financial market had been severely shaken by the collapse of an overleveraged dollar-equivalent product. However, with the introduction of blockchains such as Ethereum and its native cryptocurrency Ether (ETH), one can transact faster than traditional banks, and several decentralized applications (DApps) can be developed to eliminate intermediaries from the financial system.

Since they don't need to be connected to a single centralized server to function, DApps are more reliable and adaptable than centralized applications. This implies that organizations may guarantee minimal downtime and interruptions for optimum business resilience.

The cryptocurrency, a key fintech product, lessens the reliance of the financial trade on financial intermediaries and aids in developing the digital economy. But, what problem does cryptocurrency solve for businesses? Some corporations use only cryptocurrencies to make payments more manageable. For example, simply converting fiat currency in and out of crypto to receive or send payments without ever touching it is one way to ease payments.

Can we rely on cryptocurrency?

Peer-to-peer transactions worldwide have become more manageable with cryptocurrencies, but their high volatility is a drawback in the path of their mainstream adoption. Also, since the digital currency is yet not backed by the government, no one will repay your money if your funds get stolen during a crypto heist.

Also, the value of cryptocurrencies depends upon their demand and supply, and if there is no demand, investors will withdraw their money, and the underlying cryptocurrency will crash. Despite this, cryptocurrency offers a fresh way to improve several more conventional Treasury activities, like facilitating quick, immediate and secure money transfers, enhancing the management of the company's capital, and managing the potential and cons of making digital investment decisions.

Introducing cryptocurrency now could assist raise your firm's internal knowledge of this new technology. Additionally, it might support the company's positioning in this important emerging market for a time when central banks might issue digital currencies.

Through established investments that have been tokenized, as well as new asset classes, crypto may provide access to new capital and liquidity pools. Cryptocurrency offers several alternatives that are not possible with conventional money. Programmable money, for instance, can enable correct revenue sharing in real-time while boosting transparency to ease back-office reconciliation.

Will cryptocurrency replace fiat money?

There is no inherent worth in either fiat currencies or cryptocurrencies. Their value is the product of user trust, placed in the central banks for fiat currency. However, in the case of cryptocurrencies, trust is established in blockchain technology and validated consensus.

While fiat currency is centralized, issued and managed by outside parties, peer-to-peer cryptocurrency transactions are decentralized. Many organizations like JP Morgan are investigating digital assets to not fall behind in the commercial world. Also, countries like El Salvador have adopted Bitcoin as a legal tender. However, it's difficult to estimate when transactions involving cryptocurrency and digital assets will become the norm and crypto will replace fiat money.

In addition to the above, maintaining the balance between the two centralized and decentralized currency systems is crucial to the success of users switching from fiat currencies. Moreover, the value will be added by technologies that support unrestricted decentralized access to the blockchain, fiat currencies and digital currencies, according to the Deutsche Bank's prediction of 2030.

Nevertheless, the pace at which blockchain technology is being adopted indicates that the time between introduction and widespread adoption is slowly closing. Thus, it might only take ten years or less before your old physical wallet is retired, and all of your money is safely stored on a blockchain ledger.

Is cryptocurrency a good investment?

Whether to invest in cryptocurrency depends upon your risk-return exposure. For example, suppose you are willing to invest in a security that is not backed by any government and is highly volatile with no explicit guarantees about the return on investment. In that case, you may want to invest in cryptocurrencies. But check if there are any indications that prices could increase further.

Herding behavior and irrationally investing in crypto assets may result in the loss of your funds. To maximize your chances of profiting, approach cryptocurrencies like traditional assets and regard them as long-term investments. Also, never invest in something that appears too good to be true. Be aware of the scams, rug pulls and fraudulent tokens before investing in BTC or any other cryptocurrencies.

Also, diversifying your investment is an optimal way to avoid risking all of your money on a single cryptocurrency. Moreover, check out the digital currency's history, the team who created it and its prospects. This is especially crucial if you are new to the cryptocurrency markets and are still learning the ropes.

To learn more about the most recent currencies making the rounds and grabbing investors' attention, you might want to sign up for a few newsletters or follow the prominent media outlets for news about the cryptocurrency projects. Last but not least, be careful not to invest more than is necessary because doing so could result in a significant loss, which could interfere with your future objectives.

Is cryptocurrency the future of money?

Cryptocurrencies are unavoidably subject to growing scrutiny and pressure from international regimes and a variety of regulatory organizations due to their rapid rise in value and global acceptance. Moreover, different and quite harsh measures against cryptocurrencies have been taken by international organizations and governing authorities, such as China's ban on crypto and nonfungible token (NFT)-related accounts.

Nonetheless, these organizations must weigh the perceived negative aspects of cryptocurrencies, such as money laundering and their potential to be used to support terrorism, against issues of national capital control to determine whether international rules are advantageous to global markets.

Additionally, government, regulators and fiat money are not the only rivals of Bitcoin and other cryptocurrencies, but altcoins like XRP and stablecoins like USDT are the direct competitors as well. Nonetheless, the analysts predicted that the value of the global cryptocurrency industry would more than triple by 2030, reaching close to $5 billion. Therefore, companies, investors and brands can't ignore the growing popularity of cryptocurrencies for very long.

However, the future acquisition of cryptocurrency depends upon investment behavior, consumer sentiment, and the widespread adoption of blockchain technology. Furthermore, we can already see many blockchain-related projects portraying that the future of cryptocurrency is bright.

It will be exciting to see the use-cases of blockchain technology beyond the financial services industry and more countries adopting cryptocurrencies as legal tender, including those that have as yet restricted their adoption.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!