Chainlink: A cross-chain crypto project

If blockchains are to provide us with the internet of money, they will need to collaborate. However, the types of data shared by blockchains, network topologies, consensus mechanisms and a slew of other characteristics differ dramatically depending on their intended application.

For example, if a logistics company uses a blockchain to track their shipments but can't communicate with the one they use to make payments, it might cause many problems.

The issue is that each blockchain is a separate universe. The requirement to trust a source outside the blockchain to supply correct information has always been a source of weakness when it comes to getting information to and from the outside world. So, what is the solution?

The answer is Chainlink, which is a decentralized blockchain oracle network that enables smart contracts to communicate securely with real-world data and services outside of blockchain networks. But why is Chainlink so important?

Chainlink is essential because it significantly enhances smart contract capabilities by allowing access to data outside the blockchain and off-chain computing while keeping blockchain technology's security and reliability assurances.

It works similarly to a blockchain in that it relies on oracles (a decentralized network of independent entities) to gather data from various sources. Chainlink also aggregates the collected data to deliver a single data point (validated) to the smart contract to trigger its execution, reducing the risk of a centralized point of failure.

Various Chainlink use-cases include accessing interest rates and pricing assets by decentralized finance (DeFi) applications to automate the settlement of contracts. Furthermore, Chainlink can be used by insurance companies to settle crop contracts according to parameters like the amount of temperature rainfall. Please read about other applications of oracles here.

In this article, we will discuss how Chainlink works, how to buy and store Chainlink crypto and whether Chainlink has a future.

LINK token

The Chainlink (LINK) DON is powered by the Ethereum token called LINK. This network enables Ethereum smart contracts to connect to other data sources, payment systems and application user interfaces securely.

Furthermore, LINK tokens are used to compensate node operators for retrieving data (honestly) for smart contracts and deposits requested by contract creators. The LINK token takes functionality from the ERC20 (issued on the Ethereum network) token standard and is an ERC677 token that allows data payloads to be included in token transfers.

Holders must stake LINK tokens into a smart contract to become a node and supply data to Chainlink oracles. This serves as a deterrent against misbehaving or submitting fake data to the network. We will discuss how to stake Chainlink crypto in later sections.

How does Chainlink work?

The purchasers and providers of data are two parties of the Chainlink network. Moreover, five types of Chainlink contracts are involved in the process, as discussed below:

Requesting contract: When a smart contract demands data, the process begins on a blockchain, and a request for information is sent out by that smart contract called a requesting contract.

Service level agreement contract: To obtain the off-chain data, the Chainlink protocol registers this request as an "event" and produces a matching smart contract, called a Service Level Agreement (SLA) contract on the blockchain.

Three sub-contracts called a Reputation contract, an Order-Matching contract, and an Aggregating contract are generated by the SLA contract.

The aforementioned parties need to perform the following steps to meet each other's needs:

Creation of an SLA contract for oracle selection

A Chainlink user creates an SLA contract that specifies a specific set of data needs. This SLA contract is then used by the Chainlink software to match the user to the most appropriate oracles that can give the data. Buyers choose the data they want, and providers compete to deliver it.

When making a bid (in an Order-Matching contract), providers must commit a stake of LINK tokens, which can be taken away if they misbehave. Once providers have been chosen, they are responsible for ensuring that the correct responses are added to the chain.

Data collection and processing

The oracles interact with external data sources in this step to receive the real-world data specified in the Chainlink SLA. The oracles then process the data and provide it back to the buyers via the Chainlink service.

Aggregation and verification of results

The final stage is to add up the oracles' data collection results and return them to an Aggregation contract. The Aggregation contract takes the data points, evaluates their validity, and returns to the customer a weighted score based on the sum of all the data received.

Chainlink aggregates and weights the data provided using an oracle reputation system, which can determine the reliability of the data sources. Data providers get paid for their honest services if everything goes according to plan.

In all of the above stages, what role does LINK play? For the services provided by node operators, smart contracts that request data pay them in LINK. Demand for data and market conditions determine the price payable to the node operators.

How to buy Chainlink crypto?

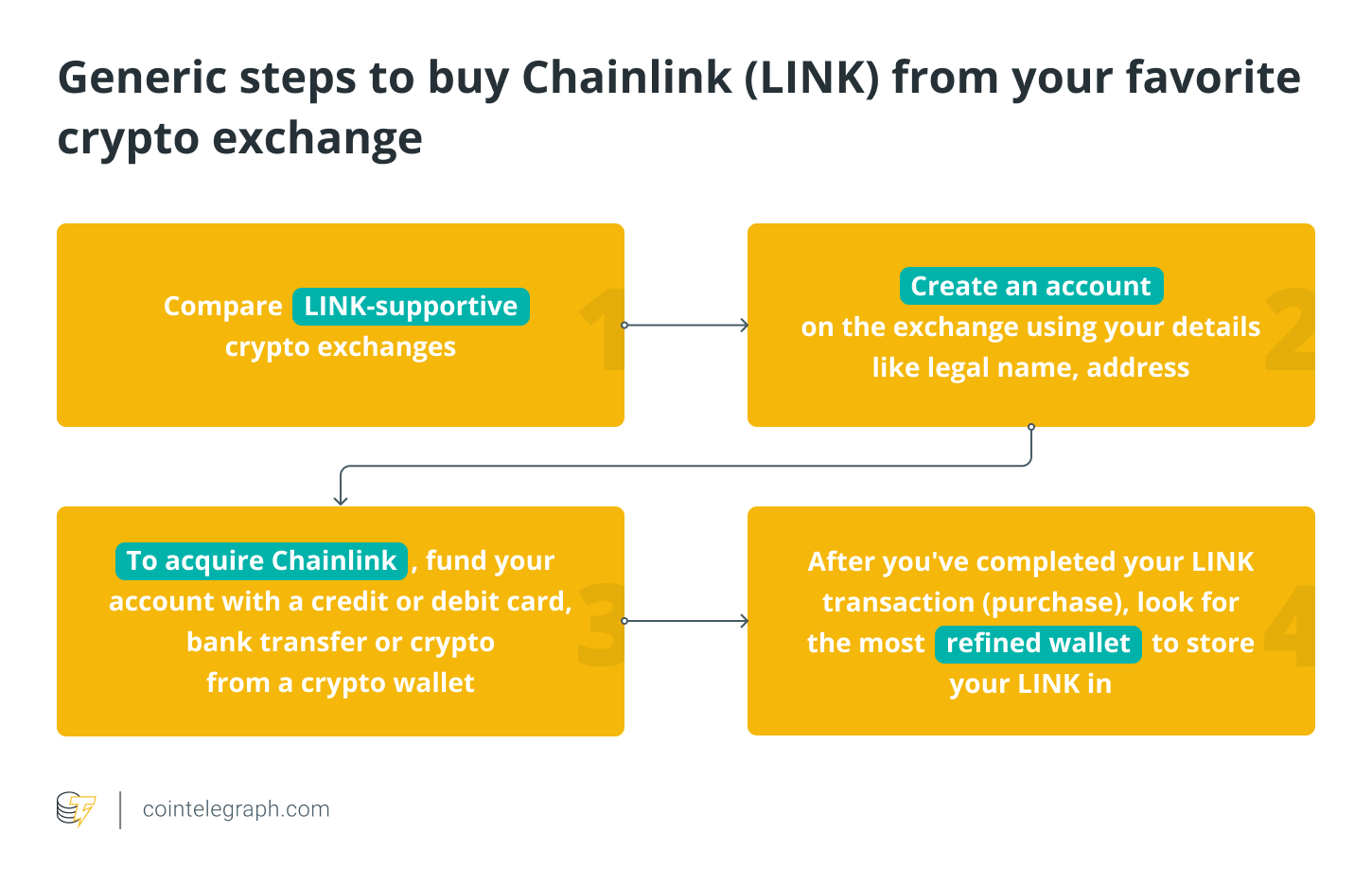

Below are the below steps to buy Chainlink from your favorite crypto exchange:

How to buy Chainlink on Binance?

In contrast to the generic steps listed above, if you specifically want to buy Chainlink coin from Binance, please use any of the methods discussed below:

Bank transfer: Using a bank transfer, purchase Binance-listed stablecoins. Then, on Binance, use these stablecoins to purchase Chainlink.

Trade Chainlink: Binance accepts more than 300 cryptocurrencies as deposits, many of which can be exchanged for Chainlink at some of the best rates available.

Credit card: On Binance, you can directly buy LINK with a credit card or a debit card.

How to buy Chainlink on Kraken?

Kraken exchange is another trustworthy option to buy LINK. Follow the steps below to do the same:

Create an account on the Kraken exchange if you do not have one yet.

Get your account verified before buying LINK with cryptocurrencies like Litecoin (LTC). On the contrary, if you want to use fiat currencies like USD, additional documents will be required for the identification process.

Fund your Kraken account and purchase LINK.

How to buy Chainlink on Coinbase?

The Coinbase enthusiasts can follow the below steps to purchase LINK crypto:

Create a Coinbase account if you do not yet own one.

Add a payment method like a credit card or bank transfer before starting to trade.

After you choose “buy,” type "Chainlink" into the search field to find Chainlink. Then, when Chainlink appears in the search results, tap it to get to the purchase page.

Input the amount you want to spend in your native currency using the number pad. This will be immediately converted to a Chainlink amount by the app.

When you're ready, tap "Preview buy." Confirm your purchase after you've double-checked the details. You own the desired amount of LINK now!

How to store Chainlink crypto?

Many people hold their Chainlink and other cryptocurrencies in the hopes of seeing their value rise. Your Chainlink can be safely stored in your Binance wallet or its crypto wallet app called TrustWallet.

Moreover, using the most trusted hardware wallet, you can protect your Chainlink funds. The funds can be stored using encrypted cold storage wallets that keep users' Chainlink assets offline, offering an extra degree of protection against the ever-evolving risks that come with being online. The Ledger Nano S (independently-certified Chainlink wallet) and the Ledger Nano X can be used to protect your Chainlink assets.

You may also use Coinbase Wallet to send crypto payments and utilize Google Drive to store your keys or the MetaMask Wallet, which offers both a mobile wallet and a desktop wallet and allows you to keep your LINK assets flexibly.

What is Chainlink staking and how to stake Chainlink crypto?

Validators in Chainlink serve as blockchain oracles, performing a more comprehensive range of services in exchange for LINK tokens. Nonetheless, if the node fails to meet any of the smart contract's conditions or is idle, it affects the usual operation of the decentralized application's (DApps). In that case, the deposit will be written off as a fine for breaking the terms (slashing).

Staking in Chainlink, on the other hand, is not the same as staking on independent blockchains. The goal of staking in blockchains is to prevent consensus attacks. Chainlink has a different goal concerning staking tokens: to ensure that correct oracle reports are sent on time. Even when a target is a smart contract with substantial monetary value, a well-designed staking system for an oracle network should make bribery attacks unprofitable for an opponent.

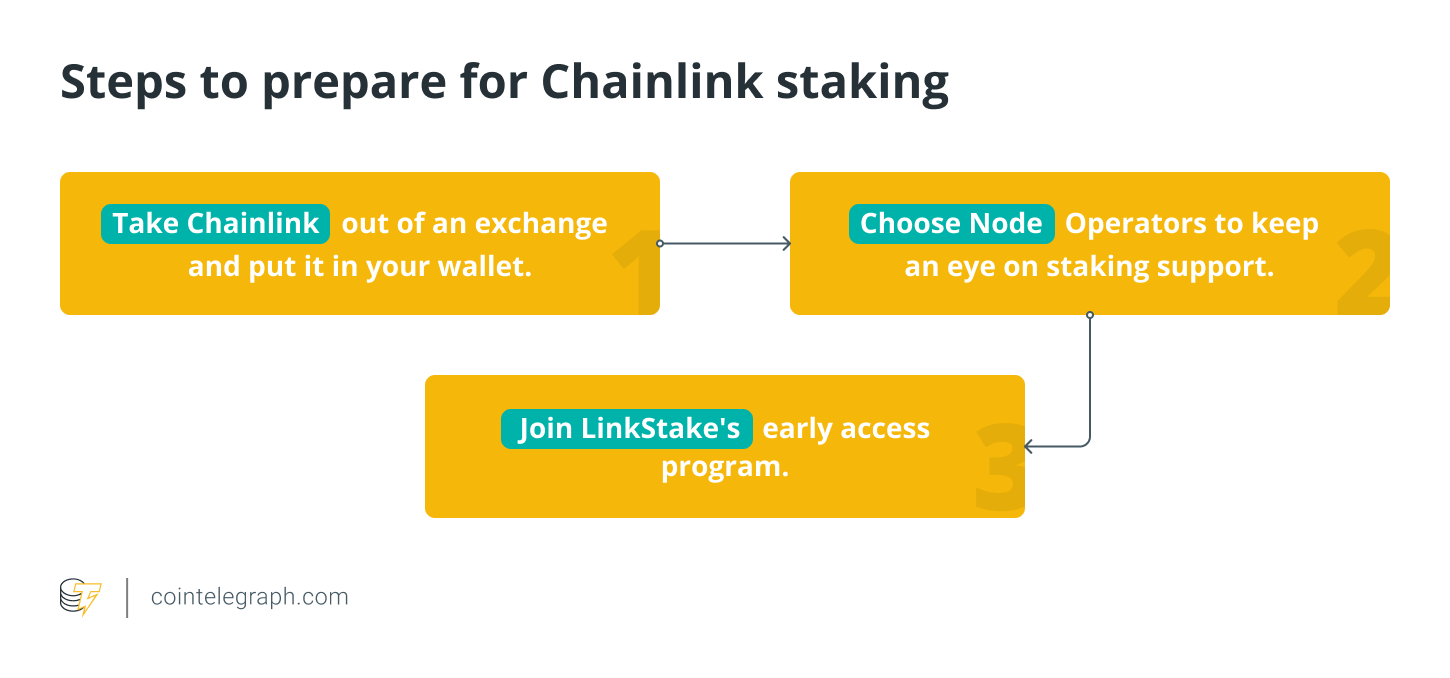

However, at the moment, staking is only available to Chainlink's node operators. Once the new staking option is available, you will be able to stake your LINK. For the time being, you can use your LINK to make passive money on other DeFi platforms by lending it out. On the other hand, you can prepare for Chainlink staking using the steps below:

What other oracle services does Chainlink offers?

Chainlink supports a verifiable random function that provides a fair and safe random number generator for smart contract applications to nonfungible tokens. Additionally, the Chainlink Cross-Chain Interoperability Protocol (CCIP) to allow users to transfer tokens and send messages across various blockchains is also offered by the protocol. For the multi-chain ecosystem, the CCIP is an open-source standard.

Moreover, Chainlink proof-of-reserve supplies smart contracts with the data needed to determine the correct collateralization of any off-chain reserves-backed on-chain asset, ensuring the DeFi ecosystem's end-to-end transparency.

What is off-chain reporting (OCR)?

Using a secure peer-to-peer network, the OCR protocol allows nodes to combine their observations into a single report off-chain. A single node then sends a transaction to the chain containing the aggregated report, which a quorum of nodes must sign. The bulk of Chainlink Price Feeds have already implemented OCR on the mainnet.

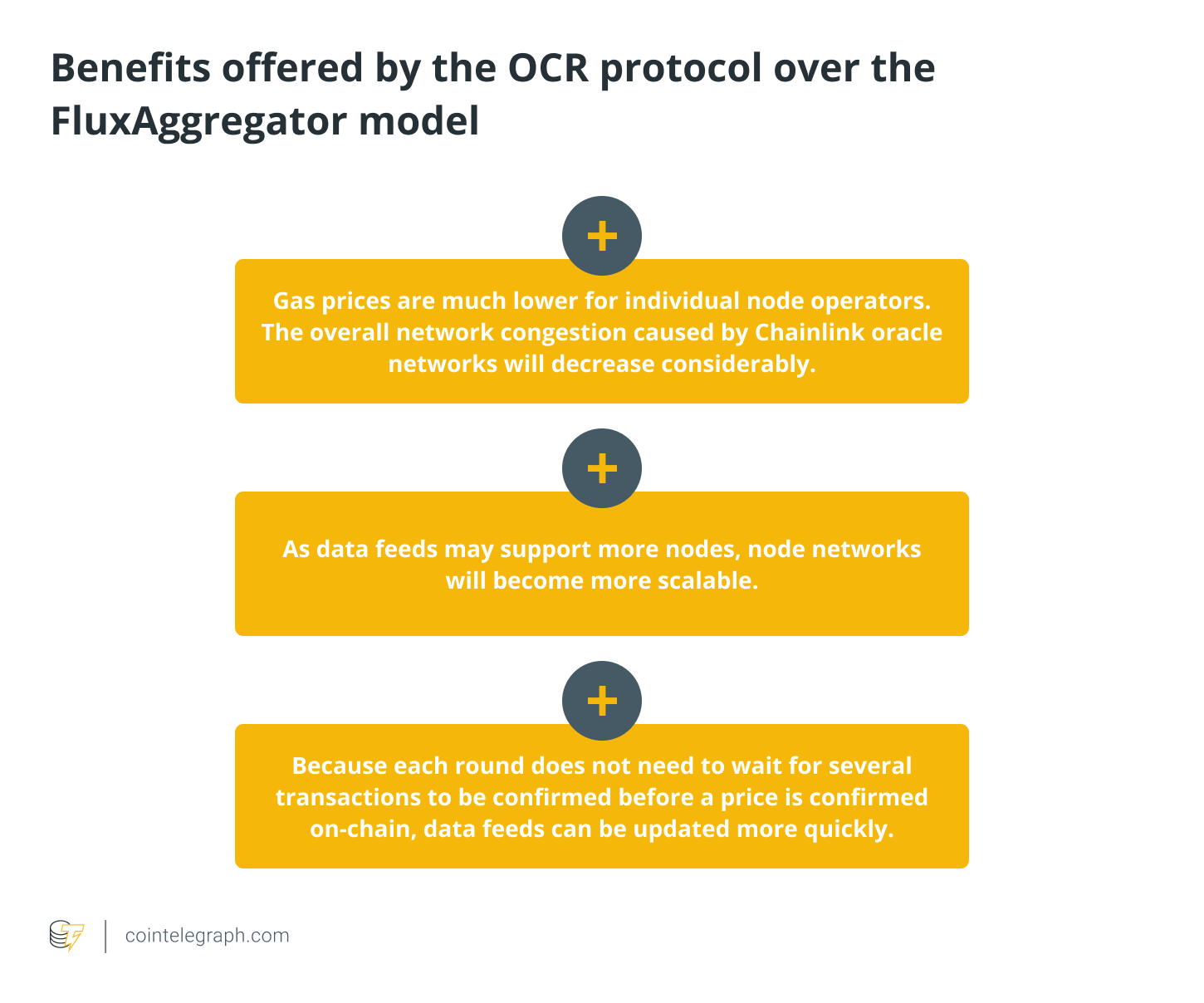

The OCR protocol will replace the FluxAggregator model in which every node must submit their price value individually, and once all responses are received on-chain, the contract combines them to confirm the price. However, the major drawback of this model includes repetitive gas fees to be paid by each node to submit a transaction per round.

Hence, the OCR protocol over following benefits over the FluxAggregator model:

Is Chainlink a good investment?

Given its services' expanding popularity, dependability and significant lead over the competitors, Chainlink has established a stable position. Now, if you want to know if Chainlink is a good investment, the clear answer is that whether an investment is profitable depends upon your investment goals and the amount of risk that you are willing to take.

Moreover, practice makes a man perfect, and to err is human, i.e., if you are a regular investor, it is likely that you will profit from crypto investments. However, if the market plays against your will, you may lose your funds (which is a possible outcome of your actions). Therefore, before committing your hard-earned money to any of the investments, make sure you understand the project, its goals and are aware of its prospects.

Does Chainlink have a future?

Off-chain networks built on top of the oracles will be one of the most advanced elements of Chainlink's upcoming updates. Off-chain networks are intended to move the majority of the complex computing activities away from the primary layer of the smart contract platform.

For example, due to the increased demand for computational power, Ethereum's gas prices have been rising, threatening to make the network unworkable for smaller transactions. Chainlink 2.0 aims to help users to overcome this proble

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!