What is cryptocurrency mining?

Cryptocurrency mining is a critical element that allows cryptocurrencies to work as a peer-to-peer (P2P) decentralized network without the need for intermediaries. It is a process in which transactions between participants over the blockchain network are verified and added to the distributed public ledger. Cryptocurrency mining also introduces new blocks to the existing circulating supply. Let's understand the mining of cryptocurrencies through the example of Bitcoin.

The first decentralized digital currency, Bitcoin (BTC), is operated by a P2P network of miners responsible for maintaining the Bitcoin blockchain. A miner is a node in the network that collects transactions, verifies them and adds them to the blockchain. The network rewards the miner with cryptocurrency, in this case with Bitcoin, when they successfully add a legitimate block to the blockchain, a procedure known as Bitcoin mining. This is how new BTC is introduced into circulation.

This article will discuss various types of cryptocurrency mining, the equipment used to mine digital assets and the costs involved in the process.

How does cryptocurrency mining work?

Miners must complete a cryptographic puzzle (part of the consensus mechanism) to add the block to the distributed ledger. This method stops rogue nodes from attempting to forge blocks and erroneously claim the reward. Nonetheless, due to the ability to send and receive anonymous payments, BTC has drawn the interest of hackers since its launch in 2009. For instance, crypto mining malware like cryptojacking takes place, which allows malicious actors to obtain virtual currencies without spending any money.

Usually, expensive hardware equipment and a massive amount of electricity are required to mine cryptocurrencies like BTC, Ether (ETH) and other altcoins utilizing a proof-of-work (PoW) consensus mechanism. This method is known as mining because the PoW resembles searching for gold in a mine. However, Ethereum is switching to an alternative consensus technique called proof-of-stake (PoS), in which validators are “randomly” selected in proportion to their current stake in the system rather than having to expend processing resources to create legitimate blocks.

How to mine cryptocurrency?

Through specially constructed devices referred to as mining machines, cryptocurrencies are mined. The development of mining equipment spans from CPUs to ASICs. The cyclical increase in mining difficulties prompted the development of new machines that were more efficient than previously created ones.

Are you in a dilemma about knowing the best way to mine cryptocurrency? The clear answer is it depends upon cryptocurrency mining cost and your budget. There are various types of cryptocurrency mining, as explained in the below sections.

CPU mining

CPU mining adds transaction records to the cryptocurrency's public ledger by using a central processing unit to carry out the necessary calculations. A central processing unit (CPU) is a computer component that provides processing power for actions taken by software installed on that computer.

In the early days of mining, hash rates less than or equal to 10MH/sec (MegaHashes per second) were efficiently mined using CPU mining software like cpuminer. So, is crypto mining profitable using regular laptops and desktops?

Bitcoin clients' earlier versions opted for CPU mining until it became unprofitable due to the high hash rate of the network. However, coins like Monero (XMR) use CPU mining to mine XMR coins profitably, and anyone with computer access can mine cryptocurrencies using a central processing unit.

In addition, a cooler for cooling hardware, a processor for high-frequency competition, memory channels and bandwidth using random-access memory, a power source for efficient hash rate and quiet support, and a motherboard for all elements' smooth communication are necessary components of the CPU mining rig.

To begin CPU mining, one can either work alone or join a group of miners. A solo miner's ability to add new coins to their crypto wallets depends on the hardware and network hash rates. However, before getting too involved in a solo mining business, weigh the revenues against electricity and other costs.

On the other hand, individual miners are drawn to mining pools where they can work together and combine their computing resources to find new blocks, enabling them to cover hardware and electricity costs. However, each mining pool has its own hardware requirements and miners need to give up some mining autonomy and are obligated to abide by the pool's regulations to join.

GPU mining

Since the power of CPU mining couldn't keep up with the escalating demand, graphics processing units (GPUs) were utilized in conjunction with CPUs to mine the cryptocurrencies. Complicated mathematical calculations were solved using graphic cards containing GPUs.

Graphics processing units were first used when Bitcoin mining software for GPUs was made available online in October 2010. Later, it was quickly optimized and modified for usage in various open-source projects. Depending on the GPU's age and cost, performance varies, but many modern GPUs offer 2,000 times the hashing power of a 20 KH/s (kilohashes) CPU miner.

Additionally, GPU miners can handle multiple operations in parallel, and some miners even combine multi-GPU mining rigs to operate 24-48 GPUs concurrently. A mining rig is a collection of separate mining apparatuses that increase mining output power or hash rates and payouts.

FGPA mining

Mining profitability was negatively influenced by the continual rise in mining costs relative to the coins obtained. As a result, GPU mining was no longer efficient because of its high mining costs and low returns. Machines that could make mining lucrative so miners could keep working in the mines were urgently needed, leading to the birth of FPGAs.

An electrical circuit known as a field-programmable gate array (FPGA) can be programmed to perform particular logical functions. That said, an FPGA miner can be configured to mine a specific coin. Nevertheless, it may be reprogrammed to mine a different cryptocurrency using a different mining algorithm if necessary at the cost of special training.

Up to five times as energy-efficient as GPUs, FPGAs achieve total cost of ownership break-even within a year or two. However, the dominance of FPGA miners was short-lived since ASICs quickly followed, offering better cost and energy efficiency. Also, FPGAs struggled to keep up with high-volume GPUs running on more sophisticated process nodes in terms of cost per GH/s.

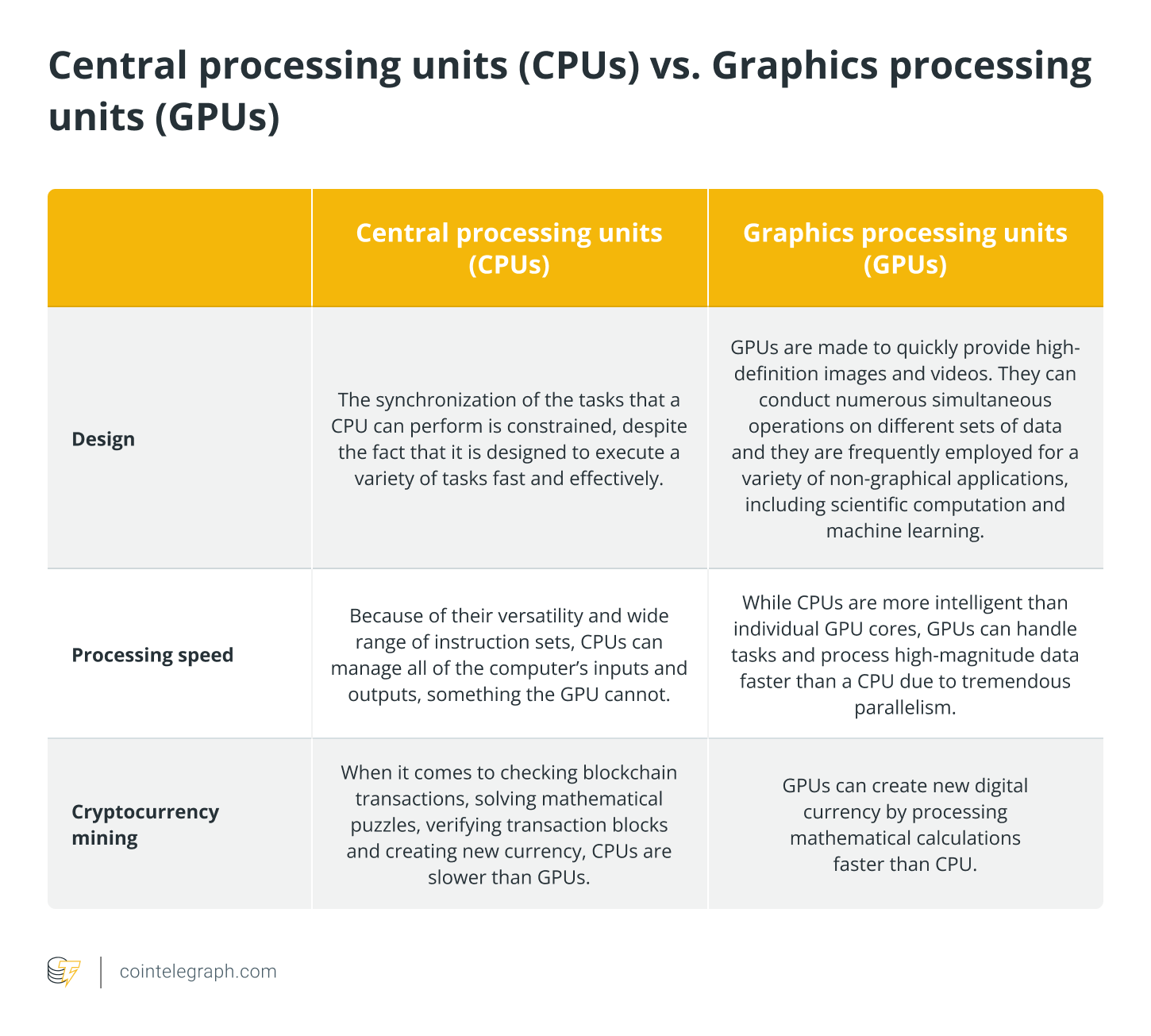

The difference between CPUs and GPUs is summarized in the table below:

ASIC mining

With time, finding improved machines at lower prices became necessary due to increased mining difficulty, creating intense competition among miners. Despite being flexible to construct and program, FPGAs made for mining purposes use a lot of power compared to the returns they produce. However, ASICs delivered a better performance than FPGAs when utilized for large-scale mining, which is what they were designed for.

Application-specific integrated circuits (ASICs), which are explicitly designed for PoW computations, perform far faster than general-purpose computing devices like GPUs or CPUs.

A power supply is crucial to install an ASIC miner, followed by an internet connection, access router, IP address, wallet and a mining pool. However, blockchain networks' decentralized character remains at risk because of skewed computer power.

ASIC-based mining has significantly increased the total hash rate of the Bitcoin network, making it unprofitable to mine BTC using CPUs or GPUs. However, because the general public must invest in specialized equipment to participate in the mining process, ASIC-based mining has a high barrier to entry. In addition, ASIC Bitcoin miners like Antminer S19 cost between $10k-12k, making it unaffordable for low-income people.

Moreover, the organizations that can acquire and keep up a significant number of ASIC systems could seize control of the blockchain network. ASIC-based mining is hence more susceptible to 51% attack. Another weakness that exists in ASIC-based mining systems includes monopolization by one manufacturer. For example, a backdoor application pre-installed on Bitmain's ASIC mining hardware was sent with the equipment, enabling the corporation to remotely manage a significant amount of the network's hashing power. Backdoor programs are software tools that give hackers or cybercriminals direct access to systems remotely.

Cloud mining

Crypto cloud mining allows anyone who wants to earn cryptocurrency without purchasing, installing or maintaining any specialized hardware or software. The miners can use the cloud's computing capability to augment or replace internal computing resources rather than spending money on more powerful servers.

The fundamental concept is that miners can conduct mining operations by renting an ASIC rather than buying one. This scheme is called hosted mining, requiring miners to pay monthly rental rates. Moreover, when losses are inevitable due to declining BTC prices or an increase in network mining difficulty, renting these machines gives the miner more accessible exit options.

In addition, the price of maintaining hardware and software for businesses is substantially reduced with cloud mining. The maintenance costs are reduced due to the requirement for fewer servers and less hardware. Since every software program relies on cloud servers, maintenance is virtually nonexistent.

In contrast to hosted mining machines, miners use hosted platform mining as an alternative option to rent virtual computers to run their own applications. The Amazon EC2 is an example of such a platform where customers only pay for the services they use. Additionally, the leasing of hashing power allows miners to rent the processing power of several powerful ASIC processors controlled by mining corporations.

Is crypto mining worth it?

The price, performance, design and implementation of a mining machine are fundamental elements that determine the mining profitability. From the above discussion, it is evident that ASICs dominate the mining industry with their performance due to their apparent advantages over the other machines available.

However, it is unclear how much longer they will be able to hold their quality against constantly increasing mining difficulty and improving mining machines. But, is crypto mining safe? Or, is it safe to mine crypto on a laptop?

Typically, laptop GPUs are less powerful and more expensive than their desktop counterparts. Cryptocurrency mining is a computationally demanding activity that can utilize your entire GPU, generating a lot of heat while processing data to validate transactions.

However, desktop GPUs feature active cooling, such as fans or water cooling, to aid in dissipating the heat they produce. Furthermore, one risks wearing out the tiny fans, which can further complicate matters and cause GPU damage; therefore, more effective crypto mining equipment is necessary to be safe.

Can you mine crypto at home?

It is not impossible to mine crypto at home. However, one needs to be mindful of the high residential electricity rates and costs of purchasing and installing a crypto mining rig. Furthermore, since the advent of virtual currencies, mining methods have advanced at an astounding rate in an effort to increase hash rates and, consequently, revenues. However, stability has always been an issue as crypto mining equipment and technologies age off at astonishingly fast speeds.

In addition, it is impossible to make a long-term investment without taking significant risks due to the volatile values of the different cryptocurrencies. Moreover, given the safety concerns associated with mining at home, unprofitable GPU and CPU mining and expensive ASIC mining, cloud mining by leasing machines appear to be the way forward.

Cloud mining offers greater chances of profit and more accessible exit options with a meager initial investment. Nonetheless, miners need to adopt cloud mining on a greater scale in order for it to be effective, and only then will the initial costs of these cloud service providers be justified.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!