The crypto industry is maturing fast, with many quick to compare it to the gold rush. And with industry maturity, users are beginning to witness a flood of traditional and retail investors flocking to the crypto space.

Venture capital funds and other institutional investors are increasingly eyeing cryptocurrency businesses to see if there's a profit to be made in financing them. Crypto startups have plenty of equity, and the mainstream is coming to view them as viable investment vehicles.

The DeFi space and the nonfungible token (NFT) market are some of the most popular areas in the crypto industry attracting venture funds. Let's explore venture capital financing in the crypto industry in this article.

What is venture capital financing?

Venture capital funds are composed of a pool of investors wishing to make a considerable amount of money quickly. Fund managers send ou

t a prospectus to potential investors inviting them to participate. In essence, a prospectus is a document selling them on the investment fund.

VC fund managers spend considerable time reviewing thousands of projects to determine growth potential. Although they're prudent investors, venture capital firms like to spread their bets. In this manner, they don't risk putting all their money in one basket.

Startups usually take the VC funding route when they're not ready to go public. Alternatively, they may not be able to gather funds from retail investors. Because of the former, crypto startups haven't sought out VC financing, but this is changing fast.

VC funds are no longer limiting their interest to crypto unicorns — rare companies that have at least a billion dollars in valuation, as determined by VC firms. Many VCs are adopting "pick and shovel" business models as they recognize newly arising opportunities. Pick and shovel organizations are crypto-related businesses that provide derivative services to the same user base. Such businesses include crypto tax reporting startups, cryptocurrency charting software and many others.

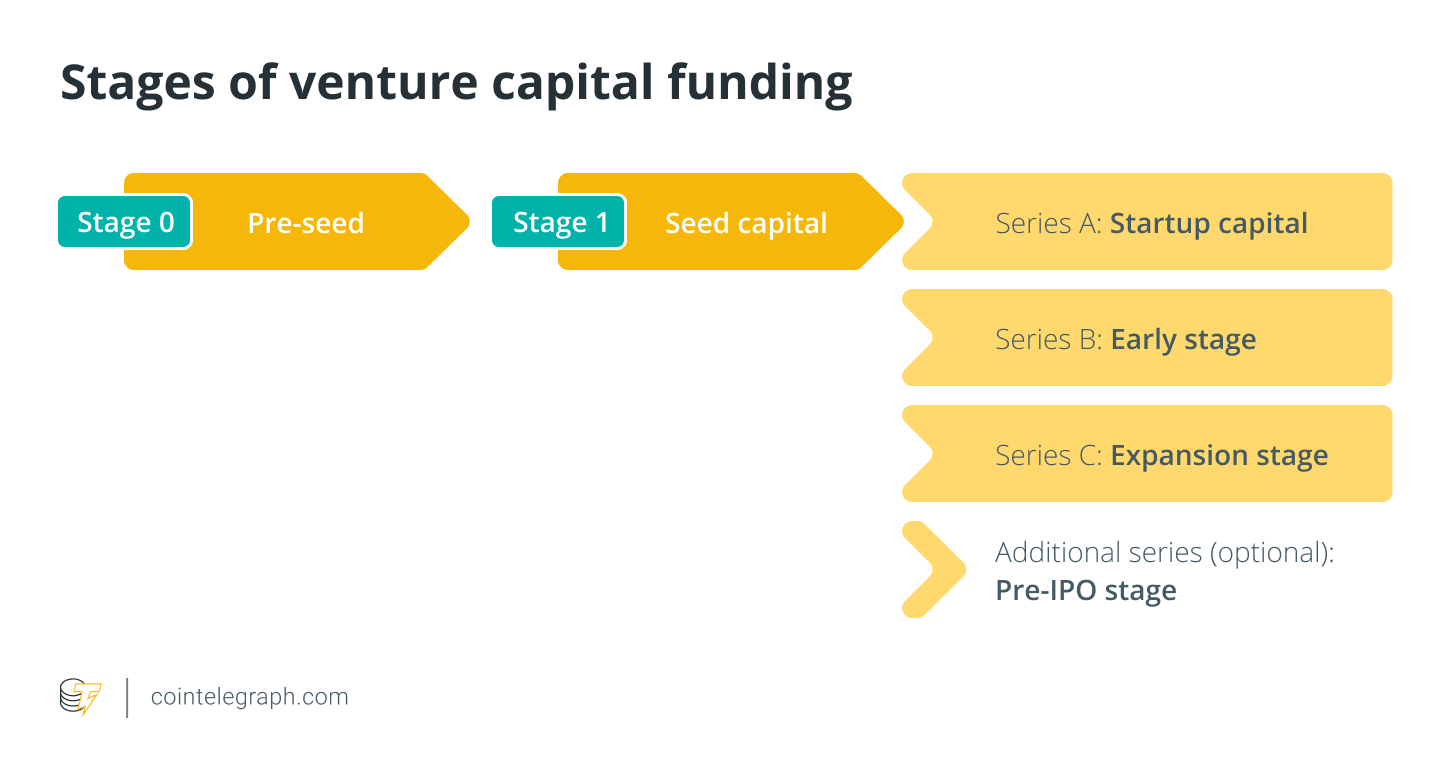

Stages of venture capital funding

Venture capital funding is usually divided into five stages. However, more stages may be added later if funding goals are not met in previous rounds, or should the founders wish to seek even further funding.

Let's cover these five stages below.

Stage 0: Pre-seed

The pre-seed stage is the ideation stage. It's often not included as an official stage because, at this stage, the involved team members aim to determine whether a founder's idea can be turned into a product. Funding is usually derived from a tight circle of family and friends, and does not involve equity.

If the founder knows the right people, at this point, angel investors may get involved. Compared to VC funds, angel investors are highly affluent individuals who tend to run solo. And unlike VCs, angel investors can choose to ignore the soundness of a project if they have complete confidence in a founder's ability.

Stage 1: Seed capital

The seed funding round is brief, and should be the shortest funding round out of all of them. This stage involves testing the viability of the product in the marketplace. The startup determines market viability by using a tool like market potential analysis. As its name suggests, the market potential analysis tool helps to provide a framework for conducting market research and ascertaining whether the product is worth putting out to market.

The startup may also have to convince the VC fund that their product is worth investing, with tools like pitch decks and financial documents like profit & loss statements, cash flow forecasts, the project roadmap, and so on. It is worth noting that angel investors may still be involved at this stage.

Series A: Startup capital

Series A is when things start to get serious. This is when equity comes onboard. Startups need not apply, because this round is reserved for cryptocurrency companies that are already in the growth stage. They have a validated product and a strong community, with steady cash flow.

What these companies are after is capital, which will help them to reiterate their product and expand further. At this stage, investors are subject to much less risk because the company's product or service will already have been validated. Furthermore, the business's focus is on customer acquisition as well as marketing and advertising.

Series B: Early stage

The Series B funding round is dedicated to further reiterations, sales and marketing. Series B rounds are all about scalability. Companies that make it to this round are in their development stage. They're seeking opportunities to expand their operations and improve market reach even further. At this point, it goes without saying that they already have a massive user base.

To speed up their expansion, the company plans to use the funds to build a capable team and solidify their product. Specifically, the company must invest in marketing and sales, human resources, business development and customer service.

Series C: Expansion stage

The last official round of VC funding is the expansion stage. At this stage, a business aims to expand to additional markets and diversify its product lines. Companies that reach Series C funding are already established in their industry. Raising funds helps them to create new products or services, and introduce their operations to international markets.

Scaling, at this stage, occurs also via the acquisition of other businesses. For example, a firm offering crypto brokerage services achieves success in the United States, and wishes to expand into the Canadian market. The firm may also try to introduce other financial services outside of its traditional scope.

At this stage, the investment risk is lower, but so are the potential returns. A startup at this level should be generating enough income—if not profit—with a commercially available product. Many expansion-funding recipients have been in business for two to three years.

This is why more external parties enter the investment management process. Apart from VCs, hedge fund managers, private equity firms and investment banks enter the foray, all with an eye on the company's equity. It's worth noting that many companies host a Series C funding round to increase their valuation before an initial public offering (IPO).

Additional Series (Optional): Pre-IPO stage

In the Pre-IPO stage, with a proven product or services, certain companies aim to go public for a number of reasons. Reasons for going public include greater access to investors of all types and additional capital, increased public confidence, and a considerable amount of publicity.

This funding round is dedicated to activities like mergers and acquisitions, approaches to squeezing out competitors, and financing to prepare for the IPO.

How do VC firms work in the crypto industry?

The cryptocurrency industry is still in its infancy, and there is infinite room for growth. Many VC firms are aware that the future belongs to crypto, and they don't want to miss out on what may well be the biggest investment opportunity of our time.

Even so, the crypto market is still volatile, but VC firms that are confident in blockchain and cryptocurrency companies are ready to assume additional risk.

Venture capital financing in the crypto space is no different from typical VC funding, with one exception. The startups benefiting from financing operate in the cryptocurrency market.

Although considered a traditional financing approach, VC funds are increasingly looking to crypto due to mainstream adoption. It is attributable to major advertising platforms like Facebook and Google deciding to lift their ban on crypto advertisements. Furthermore, with mainstream adoption by institutional investors, VCs are viewing the crypto industry as a less risky investment.

Still, this can be considered a double-edged sword. After all, more investment has encouraged thousands of new projects to rush to market. Therefore, even if only a handful might be intentional scams, the majority are high-risk investments.

But this hasn't deterred many VC funds, who are more than familiar that with high risk come large rewards. And indeed, crypto startups can give some of the highest returns in any industry. Taking calculated risks and managing risk are skill sets that VC fund managers possess, after all.

Advantages and disadvantages of VC funding in crypto

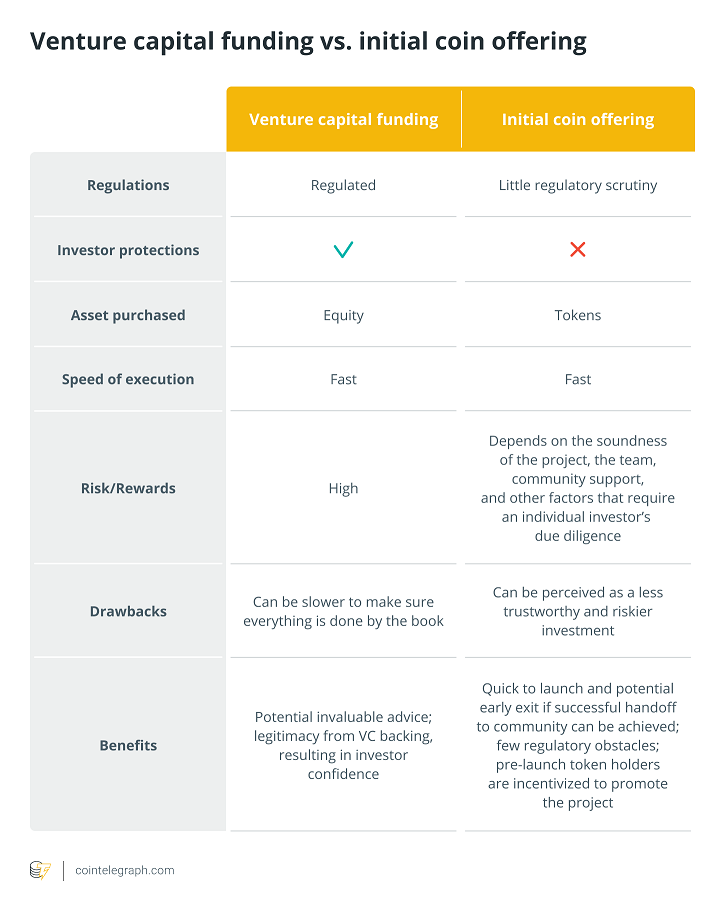

As with VC funding in general, the advantages and disadvantages for the cryptocurrency space are similar. VC firms are after high returns, which translates to equity, with a potential quick exit. This means there may be pressure to deliver quickly, as well as risk giving up some control.

One major advantage to being a recipient of venture funding is that it gives the crypto startup an air of legitimacy. This legitimacy has the potential to draw more funds from retail investors as well.

This is because ICOs and other ways of crypto fundraising introduce much lower barriers to market entry. (In many instances, a website and a decent white paper are all that is necessary to launch an ICO.)

VC funds, by contrast, will have done a lot more due diligence, like reviewing the soundness of the project and the team's ability to deliver on the project's promises, as well as researching the community and the marketplace at large to forecast profitability. Furthermore, VC funds include expert fund managers who specialize in company valuations.

Despite the drawbacks, VC investment helps to build fantastic relationships, and excels at establishing connections across various industries. Therefore, a VC firm's contacts may prove to be helpful should any challenges arise in an unfamiliar domain.

VCs understand that not all projects succeed. Sure, their main goal is to make money, but should a company fold, the company bears no commitment to repay any of the funds. Experienced investors like VC funds try to take emotions out of the equation, which should alleviate some pressure.

Moreover, VC funds have been taking calculated investment risks for a long time, so they understand how the game is played. The experience they might be able to share may prove to be invaluable investment advice for many crypto companies.

Alternatives to VC funding for the crypto projects enthusiasts

Legitimate cryptocurrency businesses may feel reluctant to take the ICO route due to the poor reputation that ICO has suffered in the past, mainly due to scams. But ICOs have come a long way since the 2017 ICO craze that flooded the market with poor projects. Should such a business find that venture capital is not the funding approach they wish to take, they may consider STOs, IEOs, and IDOs.

It's crucial to note that these approaches draw retail investors in with small funding amounts. This is in contrast to VCs and angel investors, who can introduce a sizable amount in one go.

Security Token Offerings are the closest thing a startup can get to a regulated environment. This approach is appealing for several reasons. The most important reason is that it offers reassurance to potential retail investors.

With the crypto space growing rapidly, it's understandable that many new retail investors are hesitant to hop in. The mainstream media is rife with negative stories involving scammers and rug pulls. A rug pull is when project owners dump their tokens on the market and vanish with investor funds. This is why offering an STO to new retail investors may be a solid funding approach.

Initial Exchange Offerings are similar to ICOs, but with one major difference: they are backed by an exchange. This works when a project team approaches an exchange and they come to an agreement behind closed doors.

The exchange publicly supports and lists the project in exchange for a listing fee and a percentage of the tokens. Exact agreements will vary on a case-by-case basis. If the legitimacy from a VC is appealing for a crypto startup, without having to resort to VC funds, the team may consider an IEO. Reputable cryptocurrency exchanges can lend a project considerable legitimacy as well.

Initial DEX Offerings are the latest fundraising tool available to crypto startups. DEXs (decentralized exchanges) are the bedrock of decentralized finance (DeFi). By eliminating the need for an intermediary, DEXs offer users a private and cost-effective approach to trading. DEXs can accomplish this via an amalgam of smart contracts designed to execute via code once certain conditions are met.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!