What is DeFi?

Every economic system is built on the foundation of centralization. Banks, governments and public enterprises have all served as central authorities, and people have trusted them to preserve value and maintain order in the economy.

We needed centralized authorities because we lacked the technological capability to conduct transactions on a peer-to-peer basis. However, the trust placed in those entities to maintain the financial and economic system has resulted in a great deal of authority and misuse of that power in the form of entry and adoption obstacles, excessive fees and usage limits.

Decentralized Finance (DeFi) is a new experimental type of finance that relies on smart contracts on blockchains rather than central authority or intermediaries like brokerages, exchanges or banks. This new system aims to enhance the disintermediation principles by developing a financial system that is open to anyone, where trust is verifiable via code and does not require users to place blind faith in it.

Decentralization does not imply that there is no center; instead, it means that nodes have the freedom to choose the center. For example, DeFi combines traditional banking and investment services with decentralized technologies like cryptocurrencies and decentralized applications (DApps) to provide a global financial environment that is quick, low-cost, trustworthy, efficient and entirely transparent.

This new decentralized ecosystem breaks down status, wealth and geographic boundaries by allowing the unbanked to access financial services such as remittances and digital payments. It enables them to utilize smartphones to digitally register details and obtain the information required to open bank accounts.

Blockchain safeguards their digital profiles, allowing anyone, even refugees, to receive loans and start enterprises regardless of their location. In addition, it will contribute to the solution to the global poverty problem. DeFi also eliminates the need for certain intermediaries, lowering the cost of international payments.

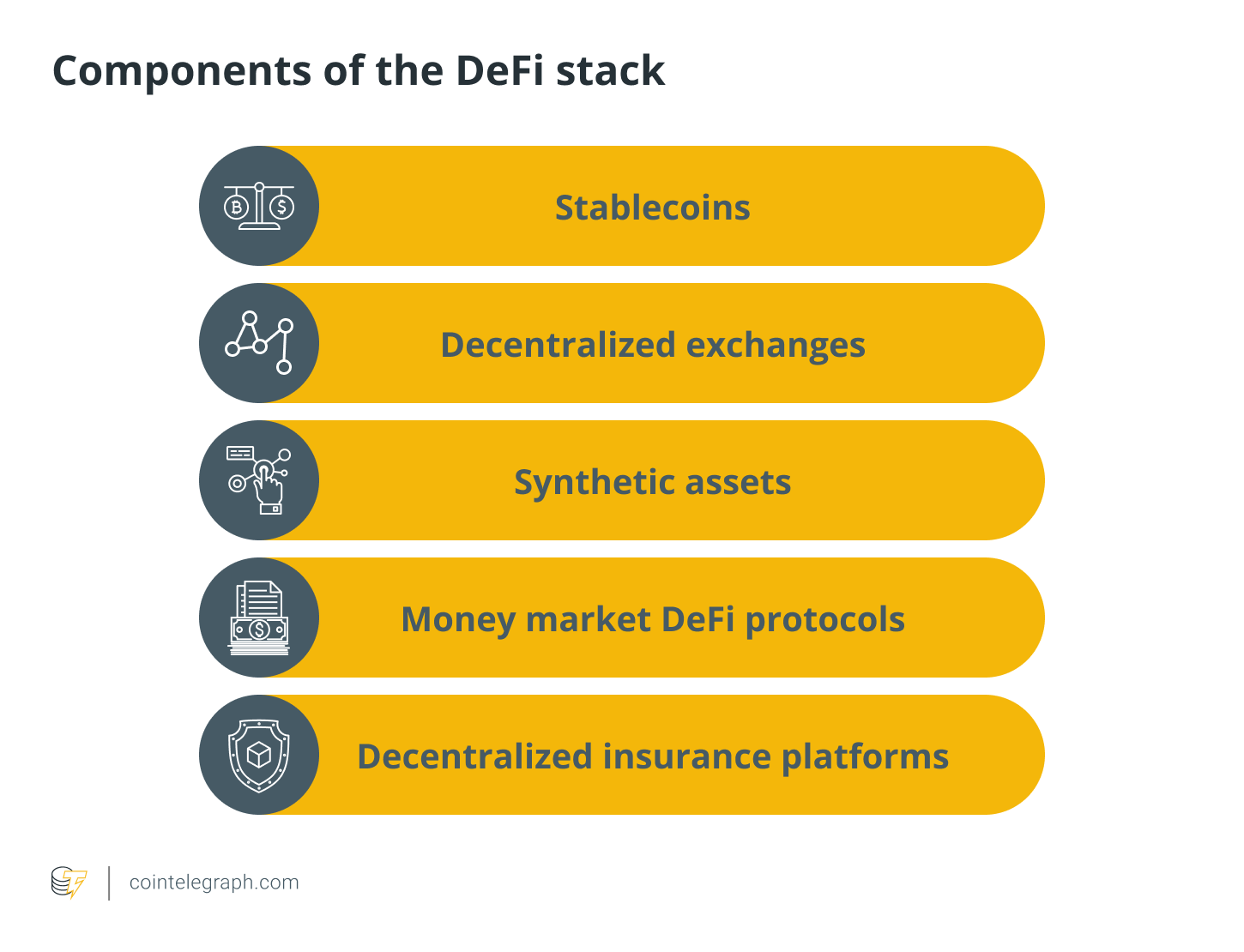

In this article, we will discuss the DeFi stack, comprising stablecoins in DeFi, decentralized cryptocurrency exchanges, DeFi synthetic assets, money market DeFi protocols and decentralized insurance platforms.

DeFi stack

Bitcoin (BTC) and Ethereum (ETH) are two examples of blockchain technology in action, each with its own set of goals. The first is digital money that can be used to make payments or kept as a store of value, whereas Ethereum is a programmable blockchain that coders can use to create valuable things.

The software built on the Ethereum blockchain is referred to as DApps due to the features of blockchain technology. These DApps sparked the creation of DeFi, a movement aimed at transforming the present financial system into one that is more transparent, decentralized and trustworthy. The components of the DeFi stack are discussed in the below sections.

Stablecoins in decentralized finance

Stablecoins try to achieve minimal or no volatility by pegging their value to price-stable assets such as gold or the U.S. dollar. The token Tether (USDT) is all tied to the U.S. dollar, meaning they have the same value as the US dollar.

Custodial-backed and algorithmic currencies are the two primary forms of stablecoins. Custodial tokens, such as USDT, rely on a currency reserve to maintain the peg. These coins have a 1:1 backing ratio, and USDT should not deviate from this ratio.

Algorithms and smart contracts are used to operate and stabilize the other form of stablecoin. This method is similar to the fiat-collateralized process, except the underlying collateral asset is a cryptocurrency rather than an actual commodity or fiat currency. DAI is an Ethereum-based algorithmic cryptocurrency that employs digital currencies as an economic incentive to incentivize arbitrageurs to keep the currency pegged to the U.S. dollar.

These coins were created to bridge the gap between fiat and cryptocurrencies and reduce the volatility associated with crypto holdings by allowing holders to switch to stablecoins at any time and maintain their value essentially unaltered.

The reserve asset supporting these stablecoins is always more than the stablecoins in circulation to avoid any liquidity difficulties. As a result, DeFi stablecoins are a critical component of the decentralized financial system since they maintain stability in the crypto market.

DeFi crypto exchange

In most markets, centralized exchanges and firms act as intermediaries to enable the trading of assets, being under-collateralized, charging some trading fees and resulting in liquidity concerns when placing orders. However, crypto assets in the DeFi market can be traded over decentralized exchanges (DEXs) without the need for a middleman.

In the crypto era, users can trade for minor swap fees and minimal custodial risk using decentralized exchanges like Uniswap while maintaining complete ownership over their assets.

Uniswap is a decentralized cryptocurrency exchange that began operations in November 2018. One of the most noticeable elements of this successful exchange is that it uses a revolutionary style of liquidity provision called "automatic market making" instead of a centralized limit order book.

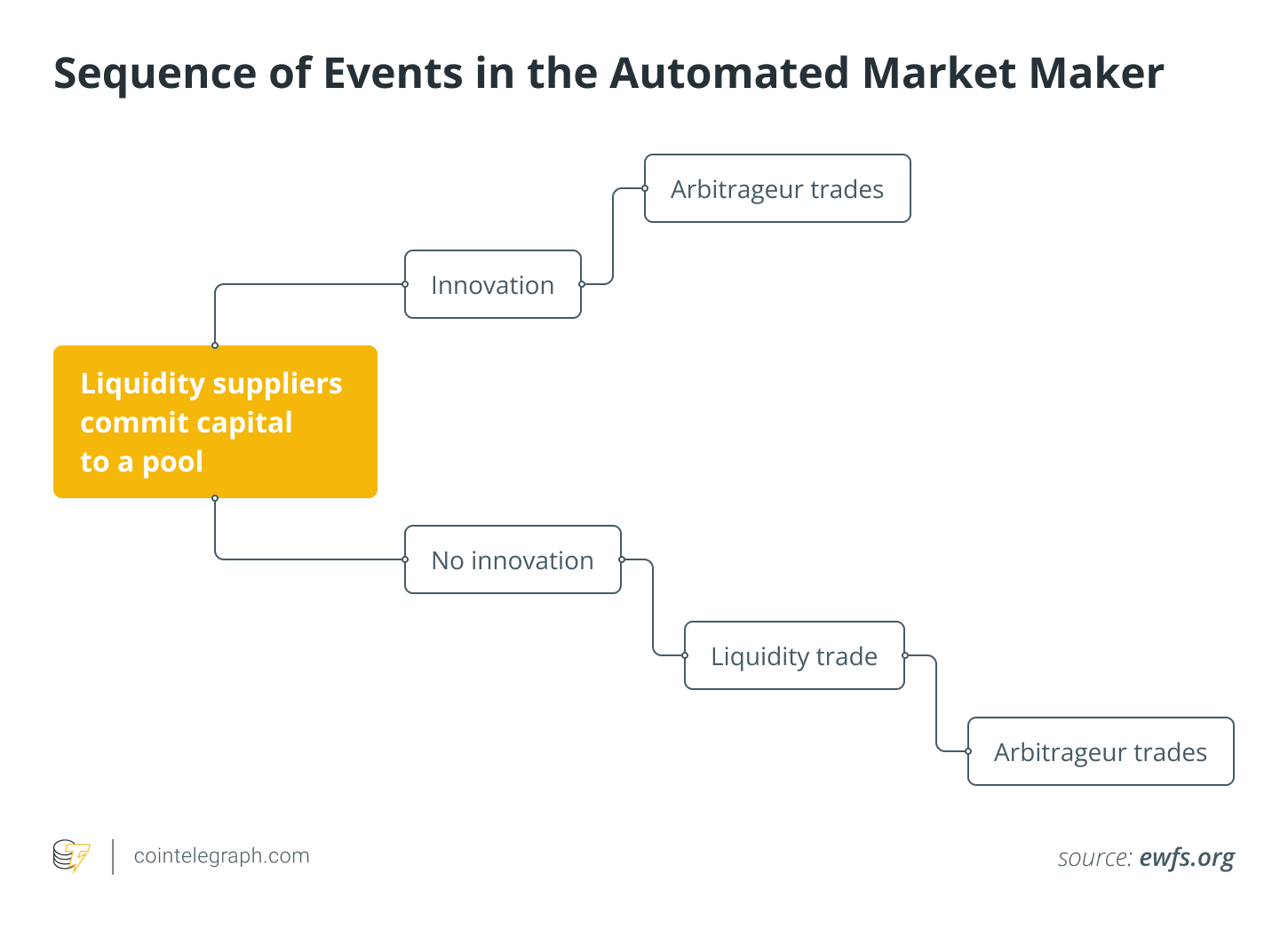

Each asset combination constitutes a separate pool or market in an automated market maker (AMM) like Uniswap. Agents provide liquidity by adding the pair to the existing pool in proportion. By introducing one item and eliminating the other, agents demand liquidity.

The average price paid is defined by the relative proportion of the two exchanged assets, which is calculated using a specified downward-sloping, convex relationship (a bonding curve). Because of the convexity, larger orders have a more significant price impact.

DeFi synthetic assets

Synthetics are financial assets that are engineered to behave like other assets. These synthetics are crypto derivatives, meaning that their value is derived from and based on other assets' value.

Synthetic products such as swaps, options and futures contracts provide investors with highly configurable risk, exposure and cash flow patterns. This form of financial instrument is required in decentralized finance to replicate operations such as liquidity, funding and market access.

There are synthetic platforms like Synthetix.io, where anyone may exchange, mint and offer liquidity for a wide range of assets due to a decentralized synthetic asset trading system.

Curious to know how synthetic investment works? Please follow the below steps:

By placing collateral, users mint (or create) synthetic assets (SNX for Synthetix). The collateral is employed to provide real value to the newly created synthetic asset.

Oracles provide real-time data about the price of the target asset to the platform, allowing the synthetic to track value properly.

Traders utilize Synthetix to trade assets such as sUSD (synthetic USD).

Minters are paid in the protocol's native asset (SNX) for minting and creating liquidity for exchange-traded assets.

DeFi money market

In the current financial system, liquidity (in the form of loans) is a critical component of any financial market that banks solely provide. Similarly, loans play a crucial role in the DeFi ecosystem. People can lend and borrow crypto assets through several different protocols. Decentralized lending systems are unusual in that neither the borrower nor a lender must reveal their identities.

Moreover, everyone can use the platform to borrow money or supply liquidity in exchange for interest. As a result, DeFi loans do not require approval and are not dependent on trusted relationships. In the decentralized financial system, money markets provide liquidity and allow users to borrow or lend money without the involvement of banks or central authority.

Like Compound, DeFi money market projects use a liquidity pool architecture to let users lend or borrow money outside the banking system. Borrowers must acquire a loan with an interest rate depending on supply and demand, while lenders can receive passive income by putting their cryptocurrency in a pool.

Unlike centralized banks, DeFi money markets allow anybody to check the amount of loans made from a lending pool to guarantee that the liquidity pool is not over-collateralized. DeFi products also offer significantly greater average returns, with some platforms giving over 10% average percentage yield on deposits. Furthermore, no credit history is associated with DeFi users, ensuring borrower privacy.

DeFi insurance

The contemporary DeFi sector provides millions of people worldwide access to financial tools they might not have had access to through the traditional financial system. But what is decentralized insurance? And what role does it play in the DeFi world?

Hackers with keen eyes are constantly seeking new methods to exploit, manipulate and profit from shiny DeFi systems like Poly Network and various other biggest heists, leading to significant losses both for the business and its consumers. To limit and cover the risks connected with DeFi platforms, decentralized insurance is deployed, which safeguards decentralized finance users from any potential threats.

DeFi insurance applications or protocols like Nexus Mutual rely on smart contracts to construct a community-based business model in which governance determines the outcome of every given insurance claim. Therefore, decentralized insurance products provide comprehensive protection for DeFi deposits, hedge risk against crypto volatility and secure crypto wallets from heists, giving investors a sense of security.

The future of decentralized finance

DeFi addresses some of the difficulties that plague the financial system, such as transaction prices, financial exclusion, poor speed and security concerns, while also giving consumers a seamless experience from anywhere on the planet.

Large, powerful institutions are a key authority in charge of the existing financial systems. However, DeFi tries to reduce or eliminate centralization and part of the power and control that intermediaries already hold. Furthermore, this revolution aims to establish a permissionless and transparent financial environment that is potentially accessible to anybody, even the unbanked.

It is valuable and novel to reform standard financial services in a decentralized approach. This new ecosystem has a lot of potential and might have a big impact on how people conduct financial transactions in the future.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!