What is Fantom (FTM)?

Fantom is a DAG-based (Directed Acyclic Graph) smart contract platform for decentralized applications (DApps). So, is Fantom centralized or decentralized?

Fantom is a highly scalable, decentralized, permissionless and open-source platform used to build crypto DApps. DAG is a data modeling and structuring technology whose networks comprise vertices and edges, unlike blockchains, which are made up of blocks. As a result, crypto transactions are represented by vertices and are stacked on top of one another.

Simply said, a blockchain system resembles a chain whereas DAG's design resembles a graph. Dr. Ahn Byung Ik of South Korea founded the Fantom Foundation in 2018, and the smart contract project has since grown to become one of the most popular blockchains for DeFi transactions.

It was created to address the shortcomings, including the lengthy transaction times of prior blockchain platforms like Bitcoin and Ethereum. FTM is the Fantom network's native coin, which can be used for governance activities, compensating validators and providing network security.

This beginner's guide on Fantom blockchain protocol aims to educate the community about the Fantom ecosystem by explaining how the Fantom Network works, how to buy Fantom (FTM) and the differences between FTM and Polygon (MATIC).

What is so unique about Fantom?

Traditional blockchain systems, such as the Bitcoin blockchain, aren't designed for scalability; rather, they prioritize security and decentralization. A transaction on the Bitcoin network, for example, can take anywhere from 10 to 15 minutes. This makes scaling the network in terms of transactions difficult.

The Fantom team aims to fill this gap by utilizing a leaderless proof-of-stake (PoS) protocol that is used to protect the network (i.e., the blockchain does not compromise security or decentralization). Moreover, a transaction on the FTM network takes 1–2 seconds to complete. Also, the transaction costs are far lower than those of Bitcoin.

The Fantom Opera mainnet is Ethereum Virtual Machine (EVM)-compatible and supports full smart contract functionality via Solidity. Fantom's network is unique in that it is self-contained, meaning that the performance of one area's traffic congestion has no bearing on other areas of the network. So, is Fantom its own blockchain?

Every application gets its own personalized (independent) blockchain with specific tokens, governance rules and tokenomics, thanks to Fantom's high level of scalability. The infinite number of decentralized systems that make up Fantom interact with one another while working independently in their own zones.

How does Fantom solve the blockchain trilemma problem?

The “Blockchain Trilemma,” which Fantom solves, is a key issue. The blockchain trilemma refers to the inability to strike a balance between speed, security and decentralization at the same time. Fantom uses a permissionless protocol and aBFT to process transactions asynchronously to accomplish decentralization and security, which speeds up the whole process.

Fantom's DAG-based asynchronous Byzantine fault tolerance (aBFT) algorithm, Lachesis, outperforms both the Classical and Nakamoto models. Lachesis is a more efficient, scalable and secure alternative that allows developers to create peer-to-peer apps without building their own networking layer.

Lachesis is asynchronous, meaning that participants can process commands at their own pace. Furthermore, there is no leader and no one plays a “special” function. Additionally, Lachesis is Byzantine fault-tolerant (BFT), which means it can achieve consensus in the presence of problematic nodes, including malicious activity. Finally, Lachesis' output is immediately usable. Transactions are confirmed in 1–2 seconds; thus, there's no need to wait for block confirmations.

Peer-to-peer networking and a DAG aBFT consensus algorithm are used to connect Lachesis to other Lachesis nodes to ensure that the same commands are processed in the exact order. The same event is repeated in different elections, resulting in a lesser number of created consensus messages. As a result, compared to synchronous BFT, Lachesis achieves a faster time to finality and a lower communication overhead.

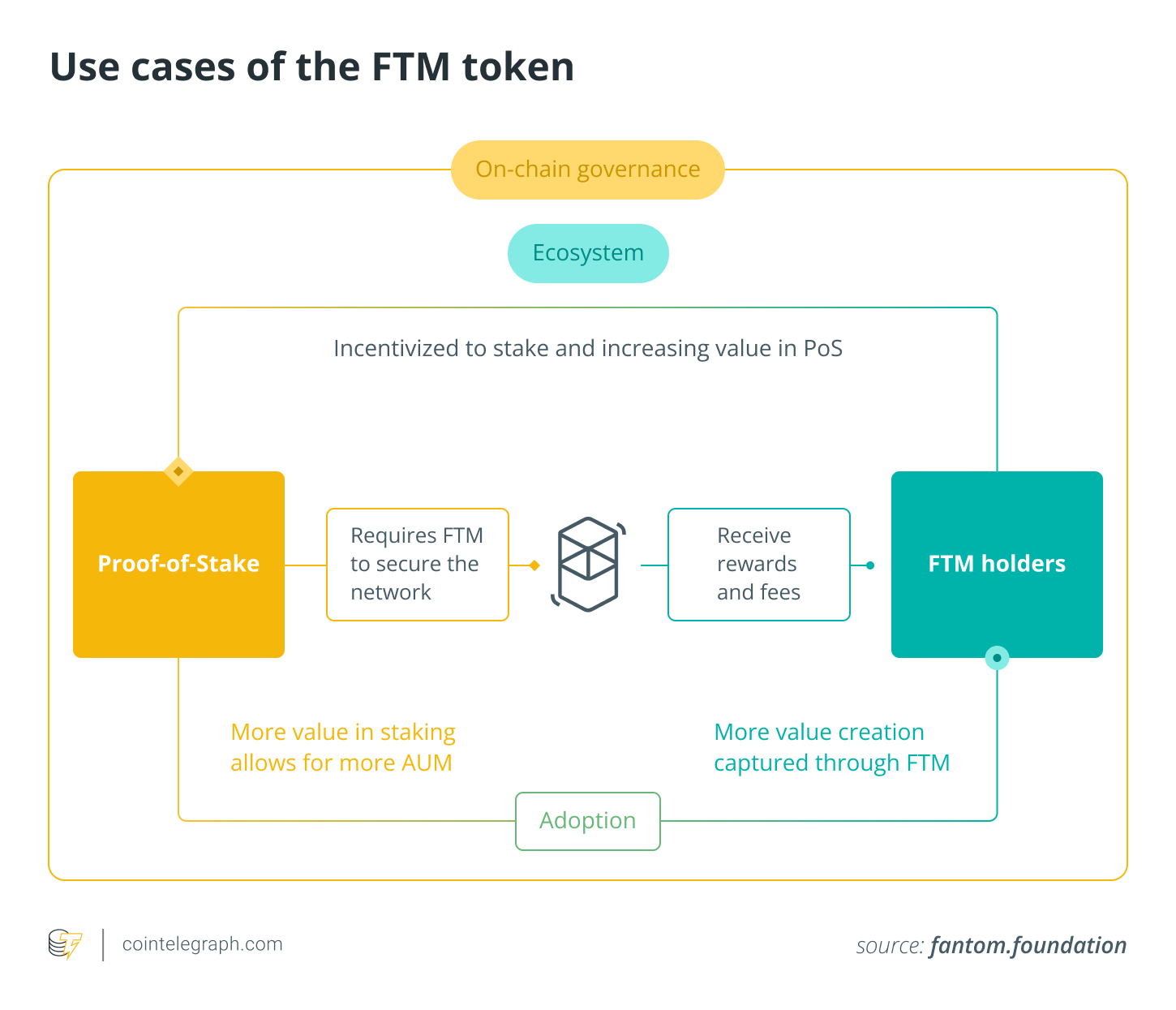

What is FTM used for?

The Fantom network's primary token is FTM, which is utilized for payments, governance, staking and fees and for safeguarding the network.

Payments

The Fantom network's speedy finality makes the payments faster (take around a second). Moreover, high throughput and low costs (roughly $0.0000001) make the FTM token perfect for exchanging money.

Governance

For on-chain governance, FTM is required where stakeholders can propose and vote on modifications and improvements through governance. Because Fantom is a fully permissionless and leaderless decentralized ecosystem, on-chain governance is in charge of all network decisions. Therefore, the governance token, FTM, must participate in the voting process.

Staking

FTM can be used to stake to secure the Fantom network and receive FTM tokens as a reward without requiring any special hardware or software. You can do it from your phone or computer — it's as simple as that!

Network fees

FTM is used to pay for network fees such as fees for deploying Fantom smart contracts or creating new networks or even transaction fees.

The fee ensures that the network is not an easy target for spam, and a malicious user cannot cause speed issues or clog the ledger with meaningless data.

Although the fees on Fantom are pretty low, they are sufficient to keep the attackers away by making entry into the system exceedingly costly for a malevolent actor.

Network security

With the use of a proof-of-stake system, the FTM token aims to secure the network where stakers need to lock their tokens, and validators need to hold a minimum of 3,175,000 FTM to participate. Fees and epoch rewards are given to stakers and validators for their services.

How to buy Fantom crypto?

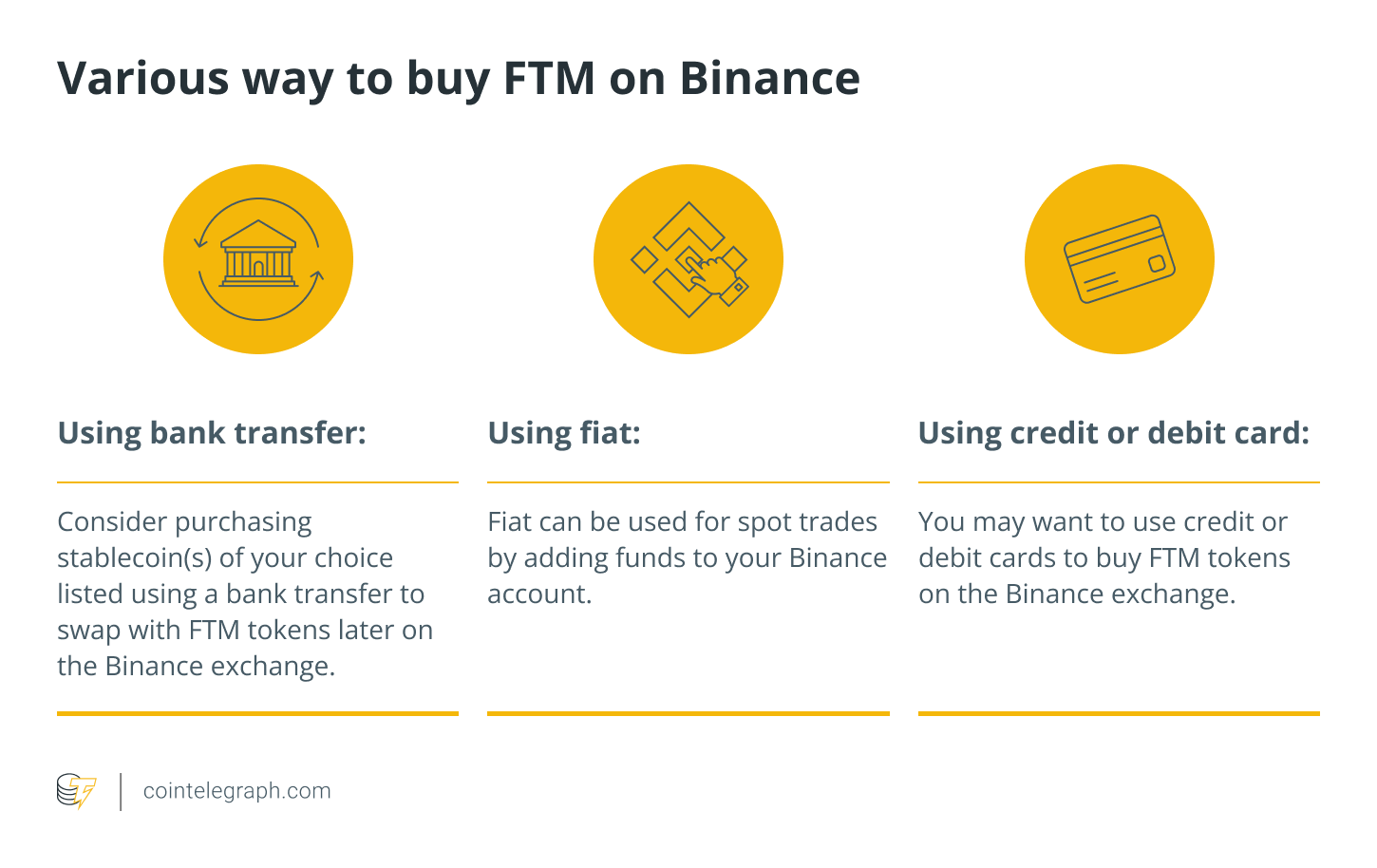

FTM is available for purchase on all major cryptocurrency exchanges like Binance or KuCoin, but Binance has the enormous volume and the most negligible slippage exchange. FTM can be purchased with Bitcoin (BTC), Ethereum (ETH), Tether (USDT) or BNB.

To buy Fantom tokens on Binance, use any of the ways listed below:

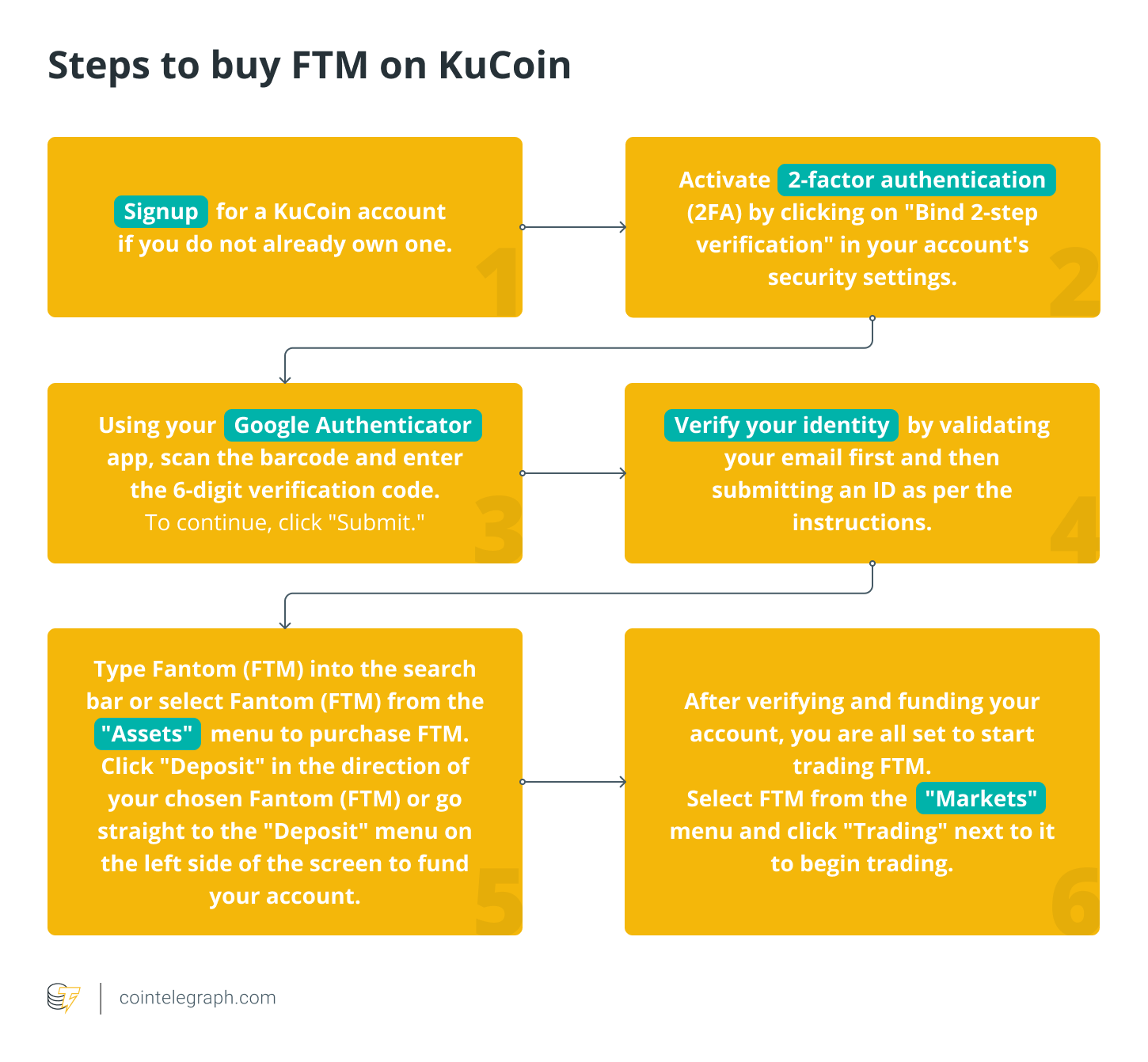

If you are a KuCoin enthusiast, then follow the steps below to buy FTM:

How to store FTM?

Because of the custodial risks, you should avoid storing your FTM on exchanges. You'd also lose out on staking rewards if you rely upon custodial services. FTM and Fantom-based coins, such as USD Coin (USDC) and fUSDT can be safely stored using wallets like fWallet (Fantom wallet), MetaMask, Ledger and other popular mobile wallets.

You may receive, transfer, stake your FTM and access the Fantom DeFi ecosystem with fWallet. MetaMask allows you to communicate with Fantom DApps and store mainnet FTM.

The most popular hardware wallet and the safest way to keep your mainnet FTM and engage with DApps on Fantom is the Ledger Nano. Coinbase wallet allows more than 1 million users to easily store FTM and access the Fantom network. Other wallet types that support the FTM token can be found here.

Staking on the Fantom network

Proof-of-stake consensus algorithm is the backbone of the staking process at the scalable blockchain platform for DeFi called Fantom.

To validate transactions on the Fantom network, you need to stake your FTM token, and in return, you are rewarded with FTM tokens. Only you can access the staked tokens and can unlock/unstake whenever you wish to.

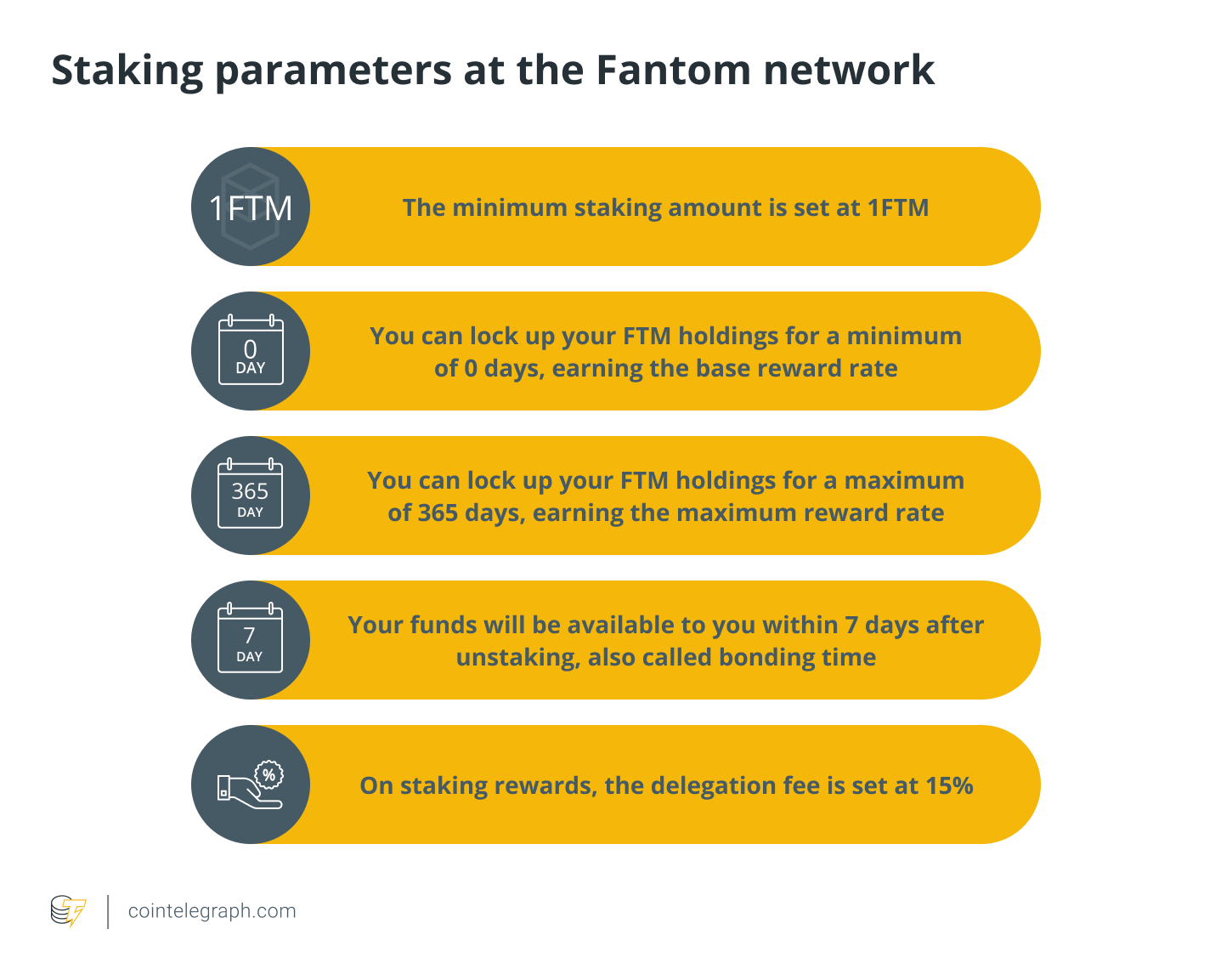

However, there are a few staking parameters that validator nodes and stakers must abide by:

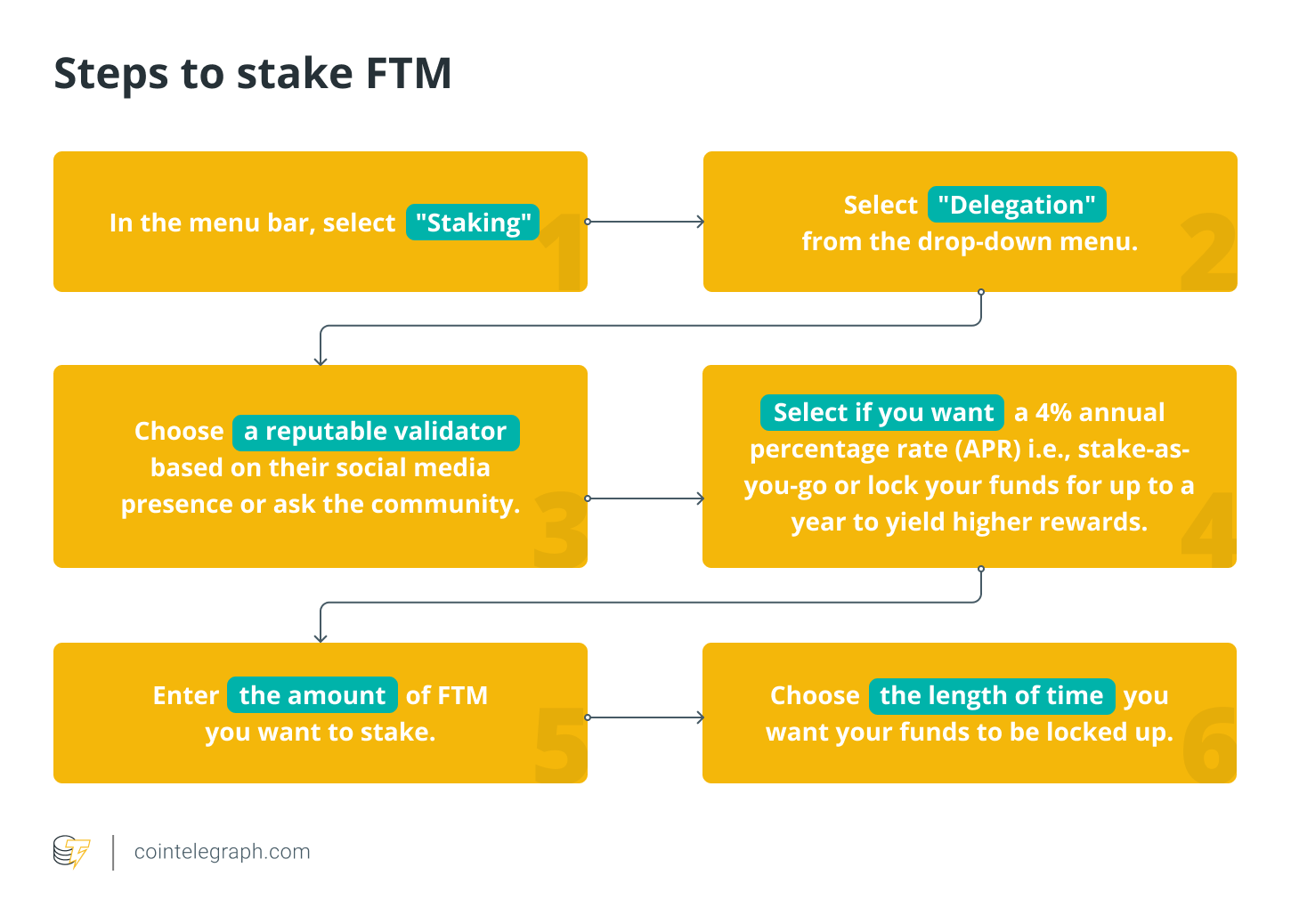

Follow the steps below if staking FTM sounds interesting to you:

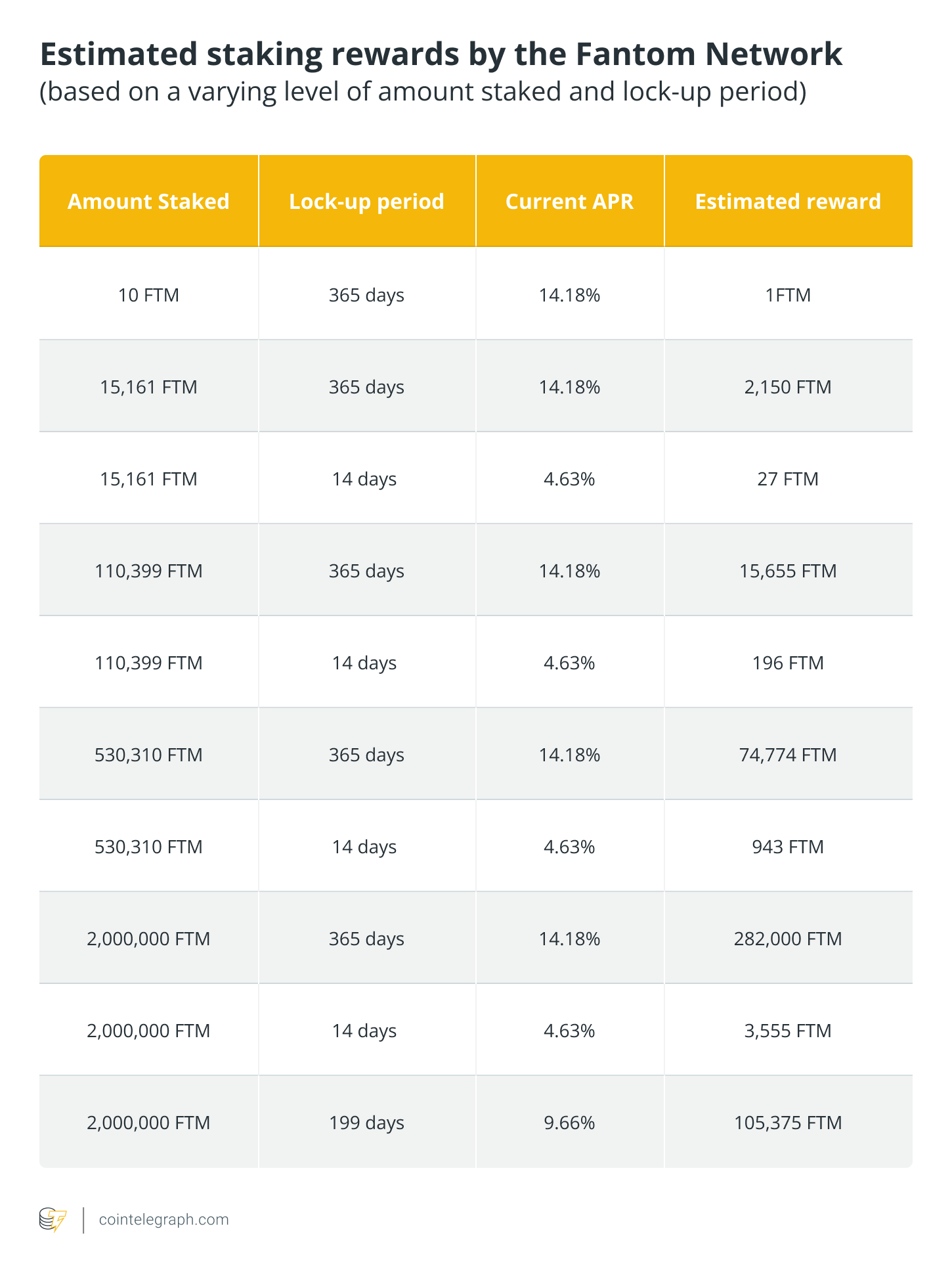

You can estimate your staking rewards here. However, we have also compiled a quick reward list for you in the table below:

If you choose to unstake your FTM holdings and then later want to restake them, you can do so by selecting the "claim and restake" option.

What is the distinction between claiming rewards, and claiming and restaking rewards?

When you claim rewards, your wallet will be emptied of all pending awards. However, you'll be able to compound the benefits with the same conditions as your initial delegation if you claim and restake.

If you lock up your tokens for a year at the maximum APR, for example, you'll get the same APR if you restake later during the lock-up. On the other hand, if you want to stake your rewards after you claim them, you'll need to start a new delegation.

Is Fantom a good investment?

Considering the volatility of the crypto market, no investment can yield rewards up to your expectations. As a result, always do your research into the protocol, team, sponsors and partnerships before committing your funds. Never invest more than you can afford.

Despite being a highly scalable platform for enterprise applications and crypto DApps, Fantom is not a risk-free investment. So, should you invest in Fantom (FTM)? The unregulated crypto market is prone to regular hacks, scams and cyber threats, making FTM an insecure investment asset like many others. Therefore, invest at your own risk.

Keep yourself updated with the ways crypto heists take place and protect yourself by using various security measures like 2FA, avoiding custodial wallets, etc.

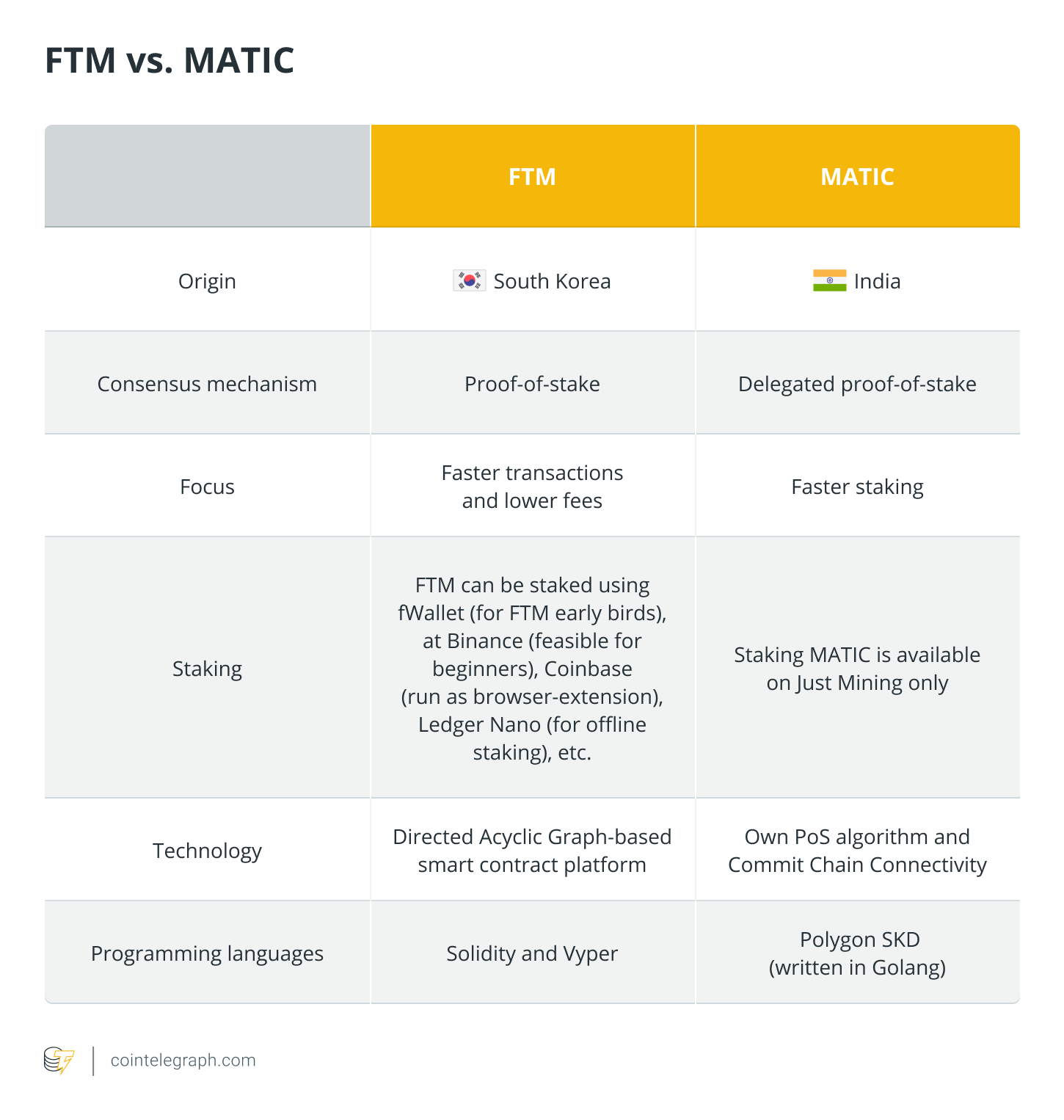

FTM vs. MATIC

Both Fantom and Polygon (MATIC) are altcoins and offer scalability to existing blockchains. However, they are different in various ways as explained below:

The future of the Fantom crypto

Being more secure and environmentally friendly than traditional cryptocurrencies like Bitcoin or Ethereum, Fantom uses the PoS consensus method and Lachesis (Fantom's aBFT consensus algorithm) to set the nodes' communication rules.

Going forward, Andre Cronje hinted that the community will see new features in his Ve(3,3) project, reportedly launching its own “emission-based" coin on Fantom to balance the Fantom ecosystem's players.

Moreover, considering the competition in the crypto arena, the founders and developers will continuously look for partnerships and sponsors to enhance the performance of the platform and build the community's trust.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!