In 2020, staking emerged within the cryptocurrency space, introducing new opportunities as alternatives to the traditional financial markets' instruments. The rise of decentralized finance (DeFi) materialized in 2020, but the concept dates back to the inception of Bitcoin, which sought to replace established intermediaries and trust mechanisms.

It signaled a new era for the crypto universe, geared toward a new, internet-native financial system, using blockchains to help investors turn the simple ownership of crypto assets into lucrative passive income through staking.

DeFi staking works through smart contracts, pieces of code representing automated financial agreements between two or more parties that offer excellent incentives for crypto enthusiasts willing to stake (lock-up) their assets and engage in a more active presence in the network.

DeFi staking aims at encouraging long-term participation in a blockchain network. This article will help you to understand how you can use your cryptocurrency assets to generate passive income and participate in securing the network, validating nodes, and verifying blocks and transactions.

What is DeFi staking?

DeFi staking is the process of locking crypto assets into a smart contract in exchange for rewards and generating passive income. The crypto assets that can be staked are fungible tokens or non-fungible tokens (NFTs), and the rewards usually correspond to earning more of the same. It's a great way to incentivize cryptocurrency investors to hold on to their assets while earning high interests.

DeFi staking is more attractive to investors who can benefit from higher rewards than a traditional savings account. Yet, it comes with higher risks coupled with more considerable challenges the crypto markets unveil, such as the well-known volatility across the board and network security of novel blockchains.

This new financial tool has become increasingly popular because it doesn't require particular trading or technical skills, and investors' most significant challenge might be choosing the right and secure platform.

Unlike proof-of-work (PoW) blockchains, which use extensive computational power to verify blockchain transactions, DeFi staking is based on proof-of-stake (PoS) networks where transactions are verified by validators who are the principal stakers of the network.

How does DeFi staking work?

Staking is inherently related to PoS blockchain networks where users lock up a specific amount of the platform's native tokens or coins and become validators. PoS blockchain protocols rely on validators to secure the network and verify transactions and blocks; therefore, these validators play a significant role in the ecosystem.

Validators who stake their assets to secure the network are incentivized to perform diligently and are tasked with reliably validating transactions and blocks or risk losing a portion or all of their staked assets.

Staking may require high stake deposits, which can be unattainable for participants. For example, when Ethereum switches to a PoS consensus mechanism, the need for validators to participate will be 32 Ether (ETH), which is a significant investment. For this reason, validators as a service and staking pool emerged as DeFi staking service providers to allow more people to participate without incurring substantial financial conditions.

Staking pools allow people to join other crypto investors to raise staking capital. Participants can then deposit any amount of tokens to a staking pool and start earning passive income proportional to the amount on their holdings.

Why is DeFi staking used in the crypto world?

Staking is an essential component of PoS blockchain platforms to provide security to the network, and it's helpful for reasons that benefit both the staking platform and the participant or the staker.

DeFi staking is crucial in PoS governance to validate or “mine” transactions and blocks. Although PoS consensus mechanism details vary among different chains, the basis of such a system of validators is common in most PoS management processes.

Staking also helps cryptocurrency exchanges and trading platforms provide liquidity for specific trading pairs and is a great way to attract new customers. Staking can be an excellent way to increase your cryptocurrency holdings.

Additionally, users receive compensation for the tasks their staking carries out in exchange for locking crypto assets. DeFi staking, on the other hand, involves more engagement in DeFi actions such as securing crypto assets into smart contracts and becoming a block validator for a specific DeFi protocol. Whether you become a validator yourself or join a staking pool, allocating all or some of your assets in DeFi staking can be rather rewarding.

How to earn passive income with DeFi staking?

Most emerging blockchains are based on the PoS mechanism because of the incentives and the less energy-intensive process it offers. PoS blockchains like Polkadot (DOT), Algorand (ALGO), Solana (SOL) and Cardano (ADA) all offer rewards to those who want to put their assets “at stake.”

Ethereum remains the most popular blockchain in DeFi and it is also transitioning to a PoS protocol.

So, how to stake crypto assets? Users deposit their crypto funds in a smart contract to perform various network functions and in return, they receive staking rewards. The stake incentivizes the maintenance of the network's security through ownership.

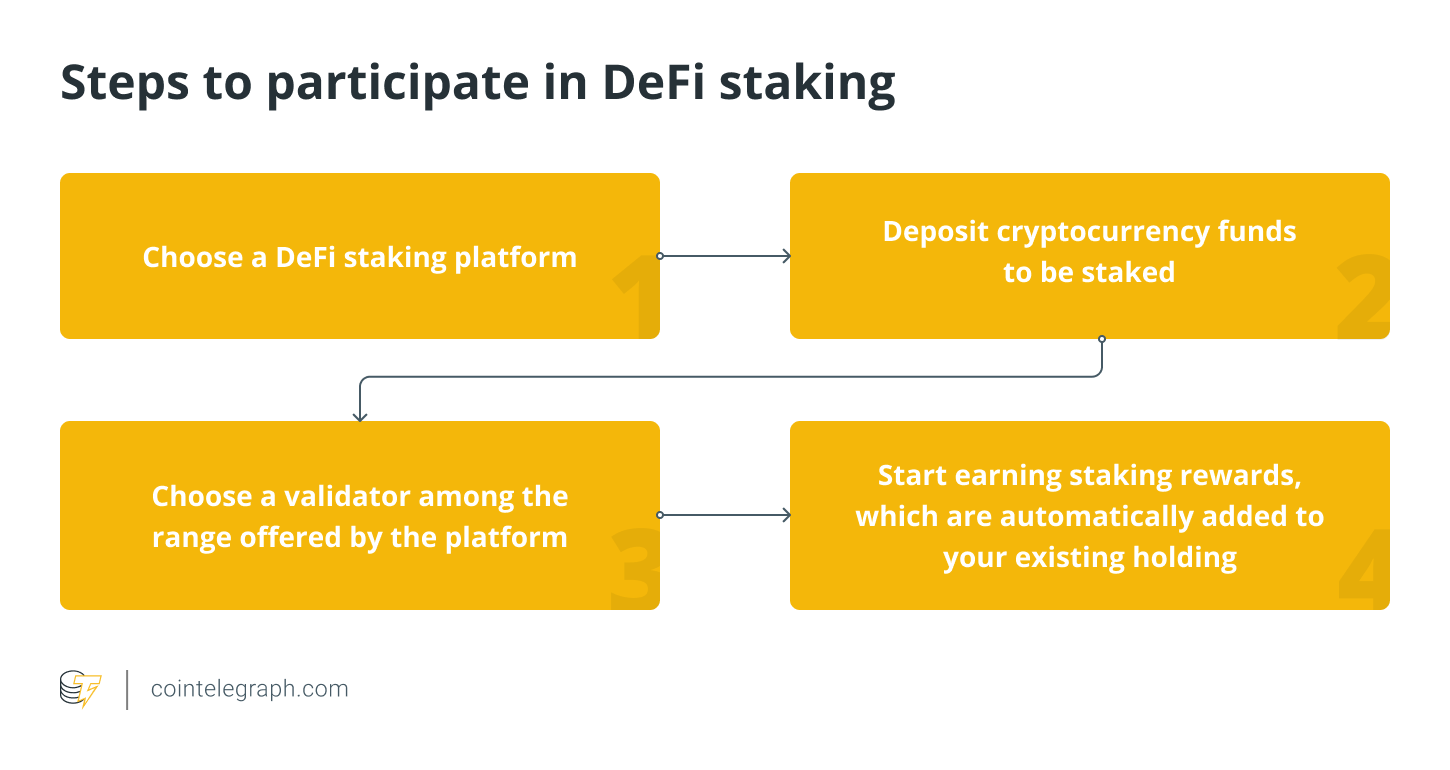

Here are a few simple steps to take part in DeFi staking:

Choose a DeFi staking platform;

Deposit cryptocurrency funds to be staked;

Choose a validator among the range offered by the platform;

Start earning staking rewards, which are automatically added to your existing holding.

Stakers do not need particular technical skills as the processes of most platforms' staking are straightforward and require following a few simple steps. There's no need for the user, for example, to create a smart contract as this will have already been incorporated into the platform's function.

Types of DeFi staking

DeFi investors should always consider the risks involved in the relatively new and volatile cryptocurrency assets. There are high rewards for those ready to face such risks, but investing in a stablecoin DeFi staking network could be the best and most beneficial solution for more moderate-risk investors. Stablecoins offer little to no volatility while typically providing good liquidity to facilitate trading and staking processes.

Synthetic token staking platforms are an emerging staking network, which allows investors to trade traditional assets like stocks, shares and precious metals using crypto. Synthetix is the most prominent existing platform of this type, built on Ethereum and based on a system similar to MakerDao, where the SNX token is staked as collateral to create sUSD (synthetic USD) and potentially, any synthetic asset.

Other than pure staking, PoS coins' supporters have different types of staking available, with the two most popular being yield farming and liquidity mining.

Yield farming

Yield farming is another sort of decentralized finance to maximize returns and functions by allowing participants to move their crypto assets across different DeFi staking platforms.

In yield farming, coins or tokens are not used to verify transactions but to provide liquidity to cryptocurrency exchanges.

Yield farmers use these platforms to lend, borrow or stake coins to earn interest and a percentage of the revenue generated by the platform. Some also speculate on price volatility. Like regular staking, DeFi yield farming is enabled by smart contracts.

Unlike the traditional markets, the benefit of using DeFi yield farming is the flexibility it produces, with 24/7 open markets, effortless automation driven by smart contracts, and unnecessary intermediaries that allow participants to access plenty of opportunities to define personalized investment strategies.

DeFi staking aggregators are platforms that aggregate several other liquidity pools and protocols — such as Ethereum and Binance Smart Chain — in a single location to maximize users' profits by saving them time and increasing efficiency for cryptocurrency trades.

Liquidity mining

Liquidity mining is similar to yield farming and consists of depositing crypto assets into liquidity pools enabling trading without intermediaries on decentralized exchanges (DEXs). In essence, liquidity miners provide liquidity to DeFi platforms by lending their holdings in exchange for rewards such as a share of the platform's fees or newly issued tokens.

A liquidity pool typically consists of a trading pair, i.e., ETH/USDC, and the so-called miner or provider (LP) can choose to stake either asset in the pool, making it easier for traders to enter or exit their positions.

With liquidity mining, the idea is that each party involved receives some kind of reward. Trading platforms obtain the necessary liquidity to grow, LPs get their share of fees, and traders get the opportunity to participate and contribute to a decentralized ecosystem with all its advantages.

DeFi protocols must provide their best incentives to be able to compete in a rapidly expanding environment for the benefit of the participants.

Advantages of DeFi staking

We pointed out that both benefits and drawbacks of DeFi staking might be different for the staking platforms and the stakers. Stakers enjoy a straightforward way of earning passive income, higher rewards than a bank savings account, and direct participation in a project's mission and the network's security and advancement.

On the other hand, the benefits of DeFi staking for staking platforms include relying on stakers (validators) to provide security and proper workflow. A large amount of staked native tokens also delivers the necessary liquidity to help a business thrive. In addition, compared to PoW, PoS brings the benefit of a lower environmental impact.

Drawbacks of DeFi staking

Other than facing the significant issues typical of the cryptocurrency space, such as high volatility and network security, DeFi staking introduces other concerns that are specific to the sector.

While many will be enticed to participate, allured by the prospect of easy gains, they also easily forget that potential risks lie in wait. Learning about such risks will help you to better assess if staking is for you and how to implement it.

Impermanent loss

Impermanent loss is one of the issues liquidity providers may experience with their money, and it's strictly related to liquidity pools. It occurs when you deposit tokens into a liquidity pool and their price changes compared to when you provided the tokens. Withdrawing the asset might occur at a loss, which is called impermanent loss.

The more the amount changes, the more you are exposed to impermanent loss. In volatile crypto, this is very likely; therefore, liquidity pools must ensure liquidity providers have worthwhile incentives to participate.

Gas prices

Ethereum's scalability problems may result in extreme spikes in gas prices, making DeFi transactions rather expensive to execute. Ethereum remains the most popular DeFi platform, and for this reason, its high gas prices may significantly slow the sector's growth.

Slashing

Slashing is a risk PoS blockchains may present. It happens when PoS blockchain validators fail to validate correctly and are fraudulent in their behavior by having downtime or double signing transactions. In that case, both the validator and the delegators could lose part of their staked tokens or rewards.

All things considered, you should keep in mind that DeFi staking is a nascent sector of the cryptocurrency space, and as such, it needs to be further practiced and evolved. While it already shows great potential and appears as a valuable alternative to the traditional financial tools, it is still at the early stage of experimentation, presenting many challenges. Still, the hefty competition between an increasing number of platforms worldwide can only help the industry consolidate while attracting more users to the cryptocurrency space.

The future of DeFi staking

Staking represents a great advantage that PoS blockchains have on PoW platforms and vows to become a prominent sector of the cryptocurrency space.

The development and opportunities that DeFi conveys are numerous, especially considering different concepts, features and services can be combined and interconnected to create a system of limitless movements and transactions. DeFi staking will take advantage of such flexibility and offer investors an increasing plethora of income streams.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!