What is DAO governance?

Creator of Bitcoin (BTC) Satoshi Nakamoto published the BTC white paper more than a decade ago, proposing a decentralized, peer-to-peer (P2P) system. Although it was originally intended to be used as a P2P currency system, the new technology now allows users to transact while maintaining data integrity and security.

The advent of blockchain has prompted concerns about new governance models involving various parties. In 2013, decentralized autonomous organizations, or DAOs, were first called decentralized autonomous companies (DAC), with a cryptocurrency serving as shares in a DAC whose bylaws are defined by source code.

DAOs, in theory, do not represent a single application but rather a firm that does not have a typical physical structure. The idea is that it runs entirely autonomously, with humans (as users) having voting power in some procedures. DAOs, unlike conditional transactional programs, are not built and maintained by firms with profit motives because they are “owned” by the users.

There are various decentralized governance models such as ConstitutionDAO, Ethereum Name Serice DAO, Friends With Benefits DAO and JuiceboxDAO, to be explained later in this article. This article aims to explain the role of DAOs in decentralized governance, how DAO treasury management works and various DAO models for governance decentralization.

How does a DAO work?

Smart contracts are used to construct the DAO's rules set by a core team of community members. These smart contracts lay the groundwork for the DAO's operations. They are evident, verifiable and publicly auditable, allowing any potential member to comprehend how the protocol will operate at all times fully.

After that, a DAO treasury is funded by issuing tokens, giving token holders the right to vote on the project's governance matters. Finally, a DAO is deployed after the funding round is completed. It is important to note that smart contract code cannot be manipulated without a consensus reached through member voting.

Related: Types of DAOs and how to create a decentralized autonomous organization?

DAO governance models

There are various DAO governance models, as explained in the sections below.

ConstitutionDAO

ConstitutionDAO is a DAO in which individuals can pool their resources to make purchases and share ownership of assets using cryptocurrencies such as Bitcoin (BTC) and Ether (ETH).

The project was started by a core group of people who persuaded many people to purchase a copy of the United States Constitution. There was a lot of discussion on Discord over the week-long process, but nothing was put up for a vote.

The DAO came very close to achieving its goal. The artifact was sold for $43.2 million. While the DAO was able to gather almost $47 million in Ether, Sotheby's ultimately limited the DAO's bid to $43 million to account for taxes and the costs of protecting, insuring and moving the Constitution. The DAO gave full refunds to everybody who donated after the auction. Those who refused refunds kept the PEOPLE governance tokens they had received in exchange for their donation.

Ethereum Name Service DAO

The legendary airdrop and request for delegates kicked off the governance decentralization for Ethereum Name Service (ENS) DAO. For each Ethereum domain registered, an ENS token is supplied. This airdrop gained a lot of attention on social media because some users received a considerable number of tokens.

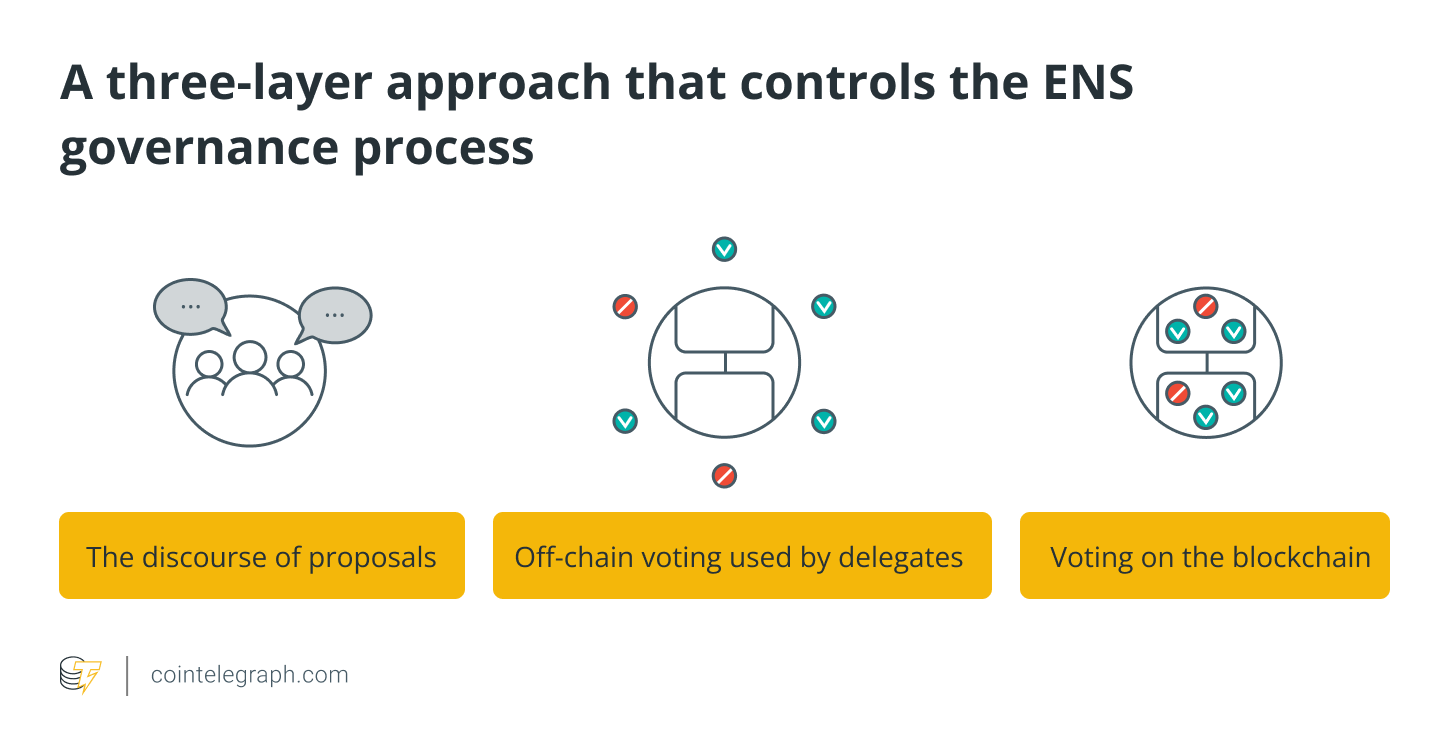

A three-layer approach controls the ENS governance process:

The majority of the proposals start in the forum or on Discord. They're later put up for a vote on Discord. The DAO's constitution was the first proposal to be voted on. This constitution served to control the suggested decisions and provide parameters for the proposals.

However, this governance approach is complicated and slow. For the proposals to move on to execution, a quorum of only 1% is required. This is a relatively low number by voting norms, implying that only a few delegates can truly move proposals ahead.

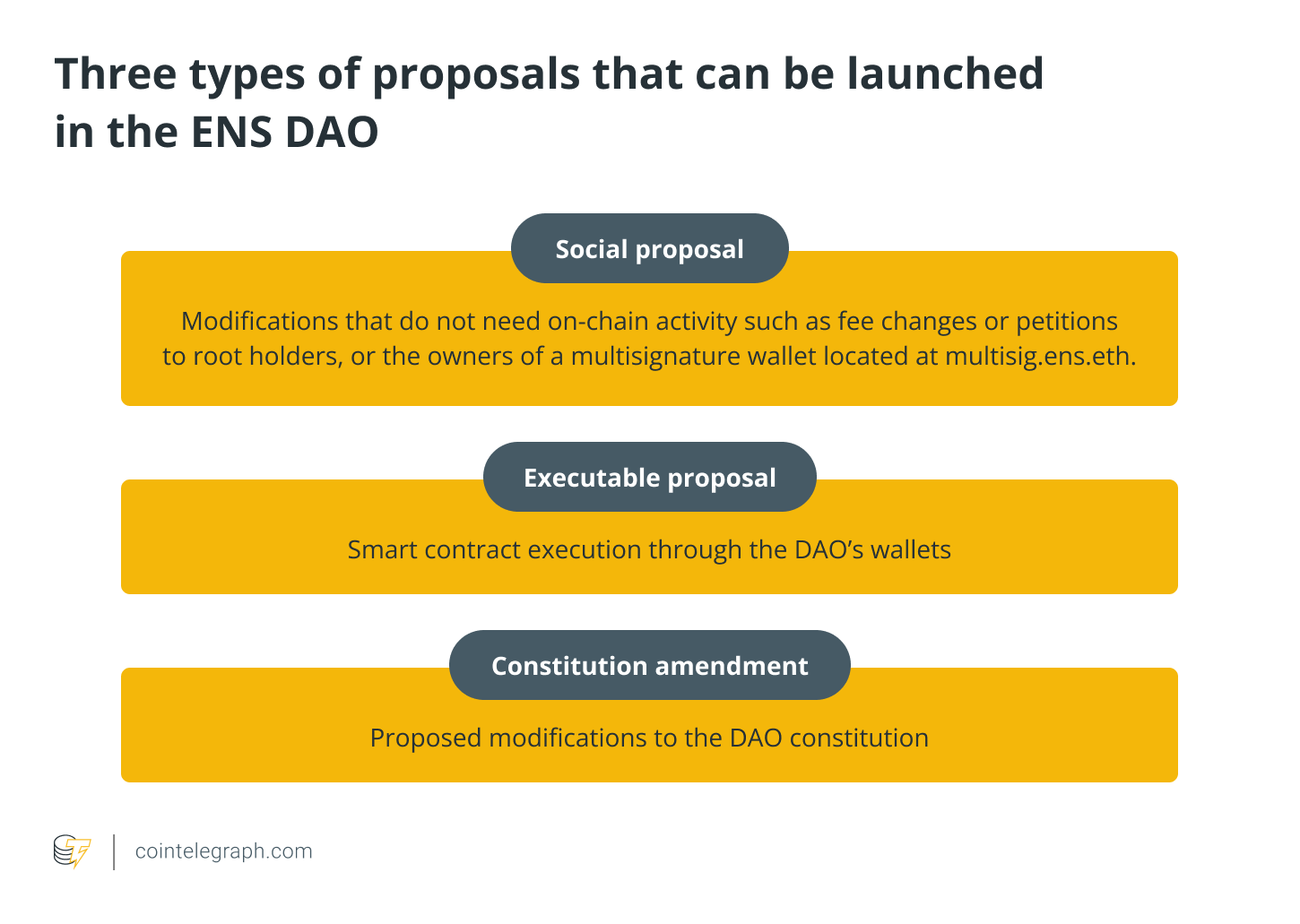

There are three types of proposals that can be launched in this DAO include the following:

The proposals can be categorized into the DAO's four workstreams including governance talks and changes in meta governance, proposals relating to the community, promoting ENS adoption and creating a vibrant ecology with the ENS Ecosystem and suggestions for public welfare.

Each group includes five stewards, who are essentially the organization's operators. They perform the following tasks:

Managing operational responsibilities connected to a working group's administration

Developing working group goals for the term and a clear road map for accomplishing those goals, which should be published in the ENS governance forum during the first 30 days of the term

Maintaining a description that outlines the working group's emphasis and objectives

Requesting funds from the DAO for a working group

Approving and making financing available to sub-groups, workstreams or contributors within a working group.

Friends With Benefits DAO

Friends With Benefits DAO is a group of Web3 pioneers including artists, innovators, thinkers and others. The FWB token serves as a portal to the FWB DAO, connecting you with like-minded people working toward a common goal.

The FWB token has a limited supply of 1 million (formerly 10 million) and cannot be minted anymore. It used to be known as the FWB classic token. However, it has since been replaced with the FWB pro token.

The Friends With Benefits DAO approach has developed from a simple governance by consensus model to a multi-group based model using Discord to communicate proposals, papers to formalize them and Snapshot to vote on the various proposals. The recommendations that receive the most votes will be put into action by the assigned team.

FWB has established an upvote paradigm in which community members can offer and upvote proposals that are of interest to them. This strategy aids in the curation of such proposals, both in terms of content and timeliness.

Following that, a proposal team drafts, organizes and cleans the ideas in preparation for community evaluation and vote. This makes the proposals' format and substance more consistent.

With FWB, the community members can access immersive experiences and one-of-a-kind products that will take them to the next level of human interactions and connections.

JuiceboxDAO

JuiceboxDAO is an unaudited platform that allows projects to raise funds from the public using Ethereum's public smart contracts. You can use its platform to create a fundraising page, set up a funding structure, determine how your project will distribute funds and award tokens to community members.

Building a treasury and awarding tokens to community members is a complex and time-consuming procedure that is out of reach for many decentralized finance (DeFi) enthusiasts. JuiceboxDAO makes it simple for organizations to set up and manage this fundraising process from start to finish, abstracting away most of the complexity.

Juicebox takes 5% of all funds raised for each project and should be factored in for all exchanges. JuiceboxDAO then rewards initiatives with Juicebox native token JBX in exchange for the 5% fee. The token holders that own a significant percentage of the JBX token have a lot of influence in critical decisions in JuiceboxDAO.

JuiceboxDAO separated the jobs into several workspaces. Each workspace serves as a collection of tasks with a common topic. This is similar to the group split proposed by other DAOs, except workspaces do not have a limited voting scope or a governing authority over their responsibilities in this case. Its sole purpose is to split the duties so that they can be attacked more effectively.

On Juicebox, the governance process is reasonably formal and centralized. The main distinction from other organizations is that their voting procedure is organized in 14 cycles. Once you have a proposal in place, you send it to a Discord channel where a group of community members will help format it in a workshop setting.

The sponsors would forward the proposal for voting once there is adequate consensus on the recommendations to the Snapshot. After suggestions have been approved, they are put into action.

The future of DAOs

Decentralized finance has added value by allowing quantified economic decisions to be validated more effectively. Because an automated trust mechanism for simple or complicated transactions has easy criteria to quantify the benefit of the decision, it has proven to be successful.

Remember: The legal status of this form of corporate entity is generally uncertain and it may differ depending on the jurisdiction. In 2017, the United States Securities and Exchange Commission ruled that DAOs might be considered an illegal offer of unregistered securities.

Despite this, Wyoming became the first U.S. state to recognize DAOs as legal entities in 2021, and CryptoFed DAO was the first corporate entity to do so. A DAO can function as a corporation without legal status, typically and legally referred to as a general partnership.

Although this partnership approach may allow for legal approval, any known participants or individuals at the interface between a DAO and traditional (regulated) financial institutions may be vulnerable to regulatory action if they breach numerous laws.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!