Crypto investors may have heard terms like launchpad and launchpool time and again. But, what are the differences between Binance Launchpad and Launchpool?

To understand the key differences, a little background is required first.

Binance has grown to become one of the main crypto exchanges since its launch four years ago. From the outset, the company has amassed a broad user base to become the world's most popular crypto exchange in terms of the trading volume.

But, is Binance just a crypto exchange?

Binance has developed its own blockchain technology known as the Binance Smart Chain. It has also launched a suite of products that allow potential investors to gain more access to a wide range of financial services. These services entail both decentralized finance (DeFi) offerings and traditional services.

DeFi provides financial services via smart contracts, which are executed once specific pre-set conditions are met. Therefore, it avoids the requirement of human intermediary.

Users familiar with Binance will have come across the platforms Binance Launchpool and Launchpad. These two platforms aim to drive support and awareness for promising blockchain startups.

Moreover, they help maximize returns for investors. But, what is the difference between Launchpad and Launchpool?

This article breaks down the differences between the Launchpad and Launchpool. This information should come in handy for users who are curious about how to participatebut aren't sure where to begin.

What is Binance Launchpad?

First, it's important to understand the Launchpad. In the crypto industry, discovering early-stage crypto projects can be difficult. Investors who manage to get in early usually secure massive returns. As a result, some crypto exchanges offer a near-guarantee of returns via crypto launchpads.

What is a launchpad in crypto?

For a launchpad, crypto investors basically participate in an initial exchange offering (IEO). An IEO is a crypto fundraising model where the project receives the backing of an exchange. The platform helps investors discover promising crypto projects before they enter the mainstream.

In other words, investors can use crypto launchpads to keep tabs on interesting projects in their infancy. One major advantage to launchpads is that they usually yield massive gains for investors, like with the BitTorrent token, which secured more than US$7 million within minutes of launching.

Therefore, Binance Launchpad is a token launch platform that assists blockchain startups in raising funds for new projects. The exchange also provides knowledge and support so that the team can broaden its reach of investors. Some token launches have generated over 30x returns for investors.

What is Binance Launchpool?

Introduced in September 2020, Binance Launchpool is a platform that allows users to stake their crypto tokens and earn new ones, all for free. This approach is ideal for investors interested in generating passive income.

How does launchpool staking work?

Launchpool staking involves using crypto assets to deliver funds into a liquidity pool. Doing so can generate handsome returns in the form of new tokens. This process is known as DeFi yield farming.

The amount of tokens accumulated on a daily basis varies by the amount staked and the total number of tokens committed to the pool. In the launchpool, tokens are calculated on an hourly basis throughout the activity period. Users are able to earn new tokens over a specified period (usually 30 days).

The token is open for trading on the seventh day of farming. At this point, users are eligible to trade any new tokens they've accumulated from the day of staking. Moreover, users can also redeem their pending rewards from the farming pool at any time.

Binance has supported roughly 20 Launchpool projects. Two of these projects have ongoing farming periods. The token distribution from 17 completed projects has reached a total of $85.3 million.

Farming pools have recorded $143.5 million worth of Binance Coin (BNB) and $5.46 billion worth of Binance USD (BUSD), the official stablecoin of Binance, in total value locked (TVL) in their DeFi protocols. (To read more about stablecoins, click here.)

The average project on the launchpool offers annual percentage yields (APY) of 24%. An APY is simply a measure of the real rate of yearly returns including compounding interest. The highest projects have recorded an APY of 113%.

The launchpool provides value to users, investors and communities. For projects, the launchpool helps them raise funds while aiding in growth.

Binance Launchpad and Launchpool deliver growth, but with key differences. Specifically, they're poles apart in the way they operate. The operating principles of these platforms are examined below.

Binance Launchpad: Spearheading crowdfunding campaigns with IEOs

With the introduction of the launchpad, Binance launched the IEO. The IEO is a fundraising model that gives investors confidence by backing new cryptocurrency projects.

But what is a launchpool?

Before the launch of Binance Launchpad, blockchain projects had to raise crypto funds via an initial coin offering (ICO). This “carefree” approach was a mixed bag of successes and failures. Many crypto users lost their funds because they did not have the necessary protections and were exposed to unnecessary risk.

The IEOs on Binance Launchpad introduced a novel approach to token distribution. Projects could now raise funds safely and users could support such projects at their convenience. Binance Launchpad supports projects, investors and the crypto industry in the following ways:

Fair Distribution of Initial Token Offerings

The launchpad initially allocated project tokens on a first-come-first-serve basis. This was an unfair token distribution method for a platform with a rapidly growing user base. In light of this bias, Binance opted to upgrade its token allocation method to a more fine-tuned lottery system.

How does the lottery system work? Immediately after a new IEO goes public, the system takes a snapshot of investors' BNB holdings. Binance does so over a given period, which varies depending on each sale.

When the BNB holding period lapses, the launchpad shows a “Claim tickets” button. The button remains live for 24 hours, during which users can confirm their lottery tickets.

After confirming the lottery tickets, the lottery commences. The winning tickets automatically allow users to participate in the IEO in exchange for their BNB tokens.

The launchpad's lottery system ensures that no crypto holder can own the majority of the tokens initially offered. Instead, those tokens become available to a broad range of users.

Exposure to the wider crypto community

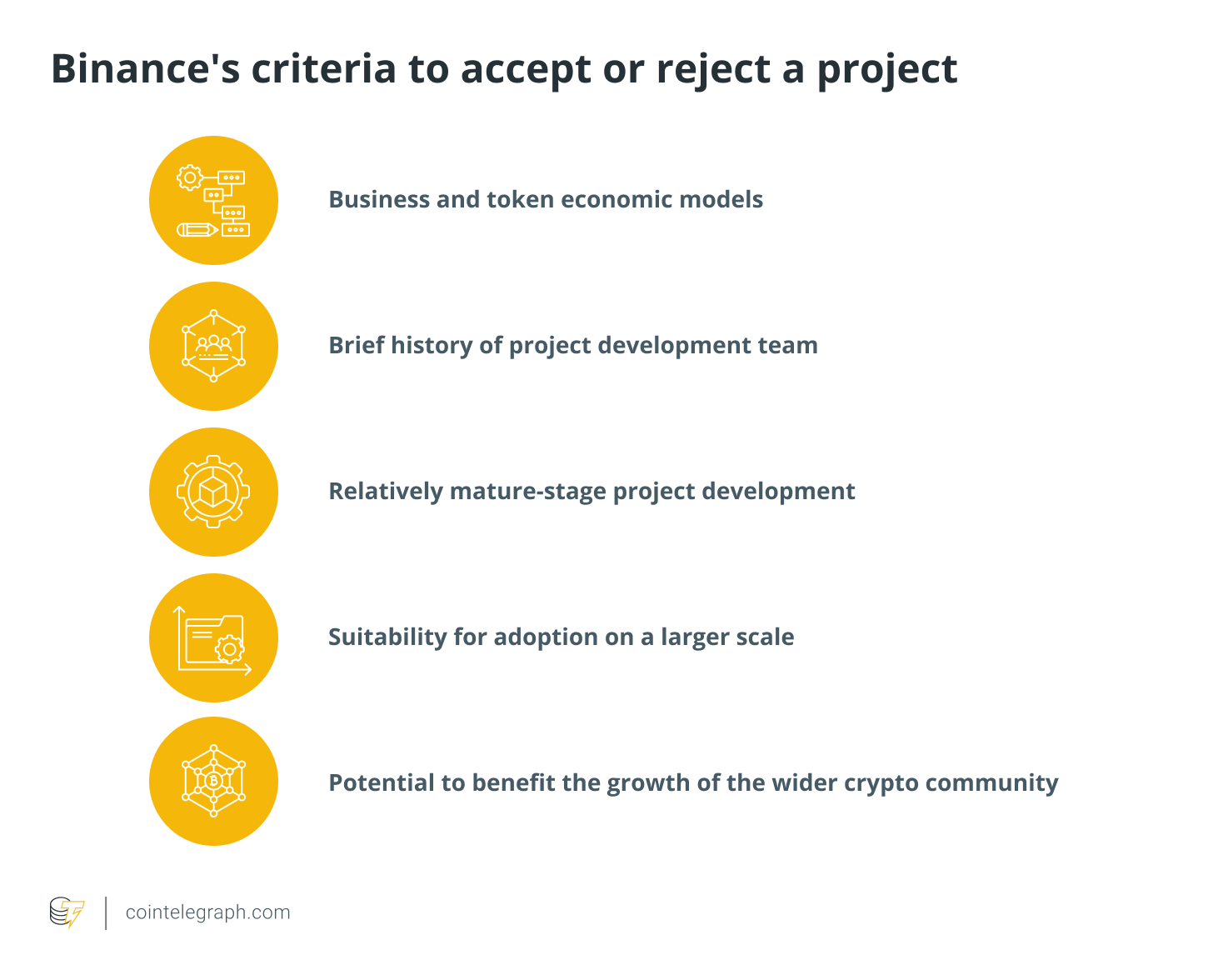

Every project listed on Binance is subject to a thorough audit before it's confirmed and approved for the launchpad. When approving or rejecting a project, Binance looks at the following criteria:

Successful projects are featured on the launchpad and receive instant buzz across the Binance ecosystem. Exposure of new projects to millions of Binance users worldwide means that those projects offer genuine utility. Thus, they're more likely to present short-term profit opportunities alongside medium-term returns.

For instance, one successful project mentioned earlier was BitTorrent. Immediately after it was listed, early investors profited instantly from its native token, BTT, when its price jumped over 300%. For longer-term holders who held through from the launch, they will have made over 1000% in returns.

Projects that qualify for a token offering receive considerable liquidity in multiple trading pairs. Binance's listing and investment teams offer 1:1 guidance for successful projects to benefit the wider crypto community. Through the launchpad, Binance demonstrates its holistic support for blockchain startups.

A safe and secure platform for token launches

In every industry, new projects are vulnerable and lack quality support, resources and promotion. The launchpad provides a secure platform for new crypto projects to fundraise without risk of attack from bad actors. As the world's most active exchange, Binance invests heavily into security for its users and token sales.

To put this into perspective, Binance has access to millions of crypto holders and investors eager to gain exposure on new projects. The platform is one of the safest in crypto. With the launchpad, users don't have to take out funds for fear of incurring losses.

Binance Launchpool: Providing value with DeFi-inspired crowdfunding

Binance created the launchpad platform in response to the rise of DeFi. The launchpad enables users to stake their crypto assets and earn new ones, all while safekeeping them.

Users can stake BNB, BUSD, or any other altcoins supported in a pool at no cost. Users receive rewards in return without having to buy the newly launched DeFi tokens.

With the launchpool, the listed DeFi tokens are distributed to a wider audience. This approach allows crypto users and investors to earn new tokens and generate attractive returns. The launchpool adds value to crypto holders, communities and the larger ecosystem in the following ways:

A platform for farming tokens

The launchpool allows you to deposit your tokens into a pool of funds and farm (or earn) new ones at no cost. The amount of tokens earned per day depends on the number of tokens staked against the total number of tokens available in the pool itself.

To participate in the launchpool, users need to commit at least 0.1 BNB or any other token supported in the pool. Trading is open on the seventh day of farming. Users can trade for roughly 30 days from the commitment period. Any pending tokens earned are redeemable at any time.

Growth and exposure for qualified projects

Much like the launchpad, the launchpool supports promising crypto projects in their infancy. Binance features qualified projects by exposing them to millions of users worldwide. Moreover, the company grants project teams access to their support system.

As a secondary effect, the launchpool creates stronger communities and supports their growth. The best performing projects on the launchpool have recorded 44x growth for tokens that are largely available to users for free.

Earn new tokens while safekeeping your existing assets

Users can earn new tokens in the launchpool while managing their existing digital assets. The tokens to be earned are calculated hourly for a specified period from the time of staking. As mentioned, users can harvest or redeem their earnings at any time whatsoever.

Ideally, the launchpool is where users farm new tokens when they deposit their crypto assets. At the end of the process, the staked amount is returned to users in full, along with what they've earned. Moreover, users can un-stake their funds at any time should they so desire.

To stake tokens in the launchpool, users may check the tokens in their wallet by first connecting their wallet to the platform. After that, users will be free to stake.

Inside a pool, users are required to hold more than 0.1 BNB or any other token that's accepted. Users are in control of their tokens and can withdraw them at any time.

Supported pools vary from one project to another. But as a rule of thumb, users can head over to the project's launchpool page and view the list of supported pools. Users can also see the APY of each pool once trading opens for the token they're looking to earn.

BNB users who stake in the launchpool still qualify for airdrops, VIP benefits and much more. Airdrops involve receiving “free” crypto tokens for supporting certain projects, while VIP benefits may include early access to a supported project.

Binance rewards users who use their centralized services as opposed to actual DeFi, but such incentivization schemes are not unique to the company. CoinMarketCap and CoinGecko adopt similar approaches as well.

Users can find out more about projects coming out on the launchpool by reading Binance Research.

Launchpad vs. Launchpool: Getting started

Judging by the return on investment, CEO of Binance Changpeng Zhao and his team have carved out a profitable niche in the crypto ecosystem. Almost all IEOs on the Binance Launchpad have proven to be lucrative, with token offerings selling out in a matter of seconds.

Hundreds of thousands of people are also engaging in the Binance Launchpool. Neither platform comes with hidden fees, so the IEOs hosted on the launchpad are just as transparent as staking with the launchpool.

More savvy investors will have many opportunities to secure greater returns on either of these platforms. Many users will be wondering, “How do I get into a launchpool?”

To start using either the launchpool or launchpad, first-time users will need to sign up and create a customer account with Binance. Users may also be required to complete Know Your Customer (KYC) verification to join. From there, it takes just a few clicks to log onto the platform and check for any ongoing promotions.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!