The Great Financial Crisis of 2008–09 no doubt destabilized the deeply-entrenched notions of financial stability that centralized finance once held. Ripples of the crisis were felt globally as banks and businesses crumbled, stocks plummeted and international trade declined.

In 2009, Satoshi Nakamoto created Bitcoin in response to the Great Financial crisis, igniting a spark that led to the rise of decentralized finance. Bitcoin (BTC) gave ordinary people access to a financial system based on decentralized consensus instead of a centralized fiat.

The crisis highlighted the harsh reality that even the world's most established banking systems could fail under certain circumstances. The cracks of a fragile, modern financial system that favored financial elites were made even more apparent, highlighting a burgeoning need to decentralize financial transactions. The cryptocurrency was born, with Bitcoin being one of the first legitimate options (outside of centralized finance) accessible to the public.

How is DeFi different from traditional finance?

While traditional finance relies on centralized governance, decentralized finance, also referred to as “DeFi,” allows people to access financial products via a decentralized blockchain network. With DeFi, there is no need for middlemen, such as banks or brokerage firms, since people can access transactions through an immutable public record of transactions.

DeFi is rooted in the notion of democratizing finance by replacing central institutions (like banks) with peer-to-peer relationships that do not require intermediaries. To grasp the idea of how DeFi will change the world, imagine this: Theoretically, the financial services available to us now, such as loans, savings, insurance and more, could one day exist on a blockchain network instead of banks.

DeFi currently allows people to undertake many of the transactions that were — until now — the purview of banks, such as lending and borrowing, earning interest, buying insurance, trading assets and derivatives, and more. The primary difference is that transactions are much quicker and do not require a third party or the paperwork typically involved in traditional finance.

DeFi removes traditional finance systems' control on the public's money, financial services and financial products. DeFi is based on secure distributed ledgers and is open to all (i.e., you can use the blockchain network and decentralized finance platforms to make payments, borrow, invest and even lend your funds regardless of who you are and your location). It runs primarily on Ethereum, allowing programmers to continue developing a wide range of secure and efficient financial platforms.

Some of DeFi's key advantages compared to traditional finance are:

People hold their money in secure digital wallets instead of keeping them in banks

DeFi eliminates the steep fees levied by banks and other financial institutions in exchange for their services

DeFi is permissionless — anyone with internet access can use it without securing approval from a central authority

Funds can be transferred in a matter of seconds

The impact of DeFi is vast. One only needs to look at how DeFi is replacing banks for the unbanked population to gauge its impact. Currently, over two billion people globally are unbanked.

According to Statista.com, countries with less stable economies have higher shares of the unbanked. In most cases, less developed financial systems also inspire distrust in the general population, further driving the percentages of unbanked higher.

However, even first-world countries such as the U.S. have an unbanked population, with lack of money being the primary reason for not holding a bank account. Financial services often come with high costs, from opening an account to paying fees and charges (such as credit card memberships, withdrawal fees, bank checks and the like). As such, it is understandable why customers with low income might not find a suitable option within traditional financial systems.

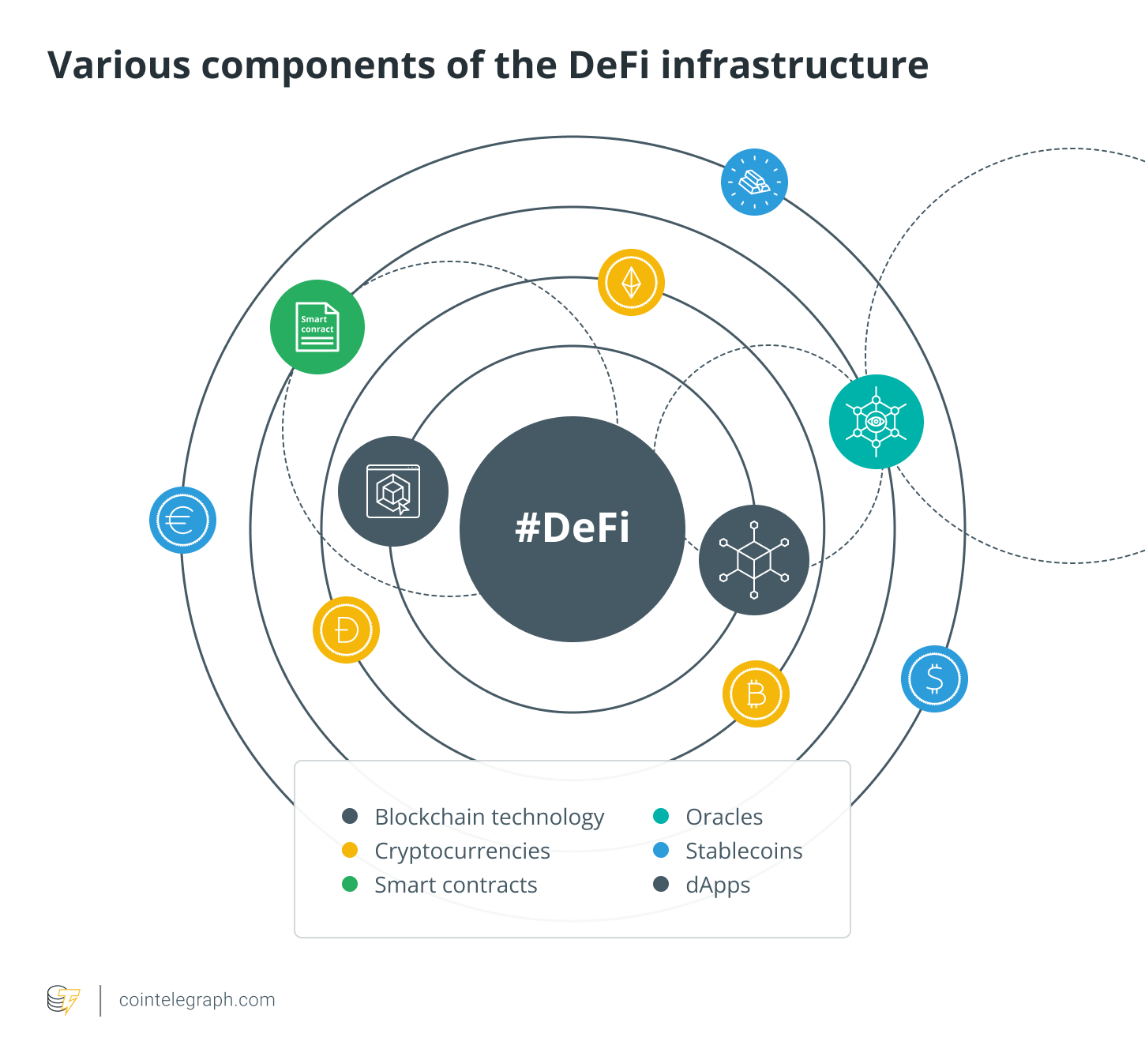

The DeFi infrastructure is composed of:

Blockchain technology: The backbone of DeFi, it is a digital ledger of transactions distributed across the entire network, making the information available on it nearly impossible to hack or alter.

Cryptocurrencies: Scarce tokens that are secured and transferred via cryptography. Bitcoin is an example

Smart contracts: A crucial component of DeFi, smart contracts allow rules for any type of transaction to be created. This is where clauses of traditional agreements can be transferred in DeFi.

Oracles: Data from an external source that feeds crucial information into blockchains with smart contracts that need to be carried out under certain conditions.

Stablecoins: A subclass of crypto that maintains price parity with reference assets (gold, U.S dollar, euro, etc.), providing stability to investors.

DApps: Decentralized applications: Fundamental to DeFi, these are software apps that work on smart contract platforms.

How can DeFi help the low-income population?

So how can DeFi help the unbanked? By providing billions of people access to a system that allows them to manage their finances and carry out transactions in a secure way.

Financial freedom with DeFi

At its most basic level, financial freedom entails having access to financial services that can help one manage their finances. Under traditional finance systems, many people with lower incomes may not qualify to take out loans, invest or even open accounts in their name.

Seldomly do banks have financial products and services that cater to the low-income populations. Traditional institutions typically have very strict requirements: high credit scores, steep fees, high incomes. Such inaccessibility further hinders those with low incomes from growing their money, creating a loop that stacks the odds against the unbanked with every step.

Unlike traditional finance, which is inherently skewed towards the elite, decentralized finance promotes equal access to financial products in a secure environment. The social consequences of decentralized finance are making themselves apparent, unfolding before our very eyes as cryptocurrency and mainstream finance continue to collide.

DeFi seems to be successful in reversing inequality across the board through diversified financial services, transparent transactions and accessibility through a permissionless network.

DeFi makes financial services more accessible and democratized

The very infrastructure of blockchain technology allows people to transact securely without being overseen by a central authority. This is something that traditional finance cannot provide because the very infrastructure of centralized finance requires guarantees (such as collateral in the case of a loan) before they can provide their services.

With blockchain technology, transactions are verified via a distributed public ledger. This ledger is accessible to everyone in the network and holds an immutable record of all transactions. The system is thus protected from fraud and corruption without needing a central party to oversee or act as a gatekeeper for the network.

DeFi projects on blockchain networks eliminate the barriers to entry on typical financial services offered by traditional banks. With DeFi, the unbanked can access opportunities and products not traditionally available to them, such as loans and investments.

Microloans and micro-investments (smaller loans and investments offered by individuals) are made possible because, with DeFi, no monetary investment required to provide a loan. The infrastructure distributes the risk among individual investors financing the loan, mitigating the need for just one single entity taking on the risk of financing. An unbanked entrepreneur in a developing country, for example, can turn to a decentralized lending pool to secure funding for his cryptocurrency project from global investors.

The opportunities with DeFi

There are many promising opportunities for investments in DeFi, but here are the most common:

Digital asset trading

Decentralized exchanges (DEXs) are peer-to-peer marketplaces where crypto traders can transact with each other directly. They facilitate financial transactions without the involvement of banks, brokers or intermediaries. Many popular DEXs, including Sushiswap, Uniswap, 0x, run on Ethereum.

Lending protocols

Decentralized peer-to-peer lending platforms like Compound (COMP) and Aave (AAVE) allow users to borrow funds with crypto assets as collateral. They also have the option to lend their crypto to other users in exchange for interest rates that are higher than traditional finance.

Yield farming

Yield farming allows for the crypto staking of assets in non-custodial DeFi protocols. Doing so allows users to earn either a fixed or variable interest rate. This can be done by either using protocols like Vesper and Enzyme or manually searching for protocols with high returns and moving assets to that platform to earn high rewards.

Community and money coming together

The main question throughout this article has been how DeFi can make money to benefit communities, especially those that are low-income. How can it be assured that the financial elites do not merely co-opt blockchain technology for their benefit? Granted, as crypto continues to go mainstream, traditional financial institutions will likewise find ways to diversify their offerings, and we're already seeing it.

The collision of these two “worlds” has been a long time coming, anyway. However, the hope is that because of the very nature of DeFi, the low-income population will have equal access to financial services, something that traditional finance has failed to offer since time immemorial.

Investment opportunities that were once limited to the rich are now accessible by the ordinary person, thanks to DeFi. Major financial institutions have also done a 180-degree turn from denouncing crypto to embracing it, even if only on the down-low:

Jamie Dimon Calls Bitcoin “Fraud,” Despite Clear Conflict of Interest

JPMorgan now offers clients access to six crypto funds … but only if they ask

While continuously being improved on, the technologies behind DeFi, blockchain and smart contracts, have created incredible opportunities for people to take control of their money outside of traditional finance.

For example, some credit and mortgage platforms have already started to use crypto as collateral. Instead of interest rates being regulated by central authorities like governments, central banks, federal reserves, etc. — they are regulated by the market, itself, meaning that interest is paid in crypto and adjusted based on market demand.

Exponential technologies like artificial intelligence (AI) and the Internet of Things (IoT) are also being used to develop regulatory projects to address their susceptibility to tax schemes and money laundering.

Through DeFi, people can invest in large-scale global projects, too. The financing of big real estate, infrastructure, tech and climate change projects can now be done with tokens and smart contracts. This revolutionizes the playing field and makes investment opportunities available to the general population, not just the elite.

Even companies that list shares on the London Stock Exchange, Tokyo Stock Exchange, New York Stock Exchange and BOVESPA (the Brazilian stock exchange) will now begin to issue tokens that are “shares in shares.” They can be acquired via DeFi, making the stock market vastly more accessible to investors from various backgrounds.

There are also large decentralized NFT marketplaces that allow users to exchange goods and services: Open Sea, BAYC and the Crypto Punks Larva Labs are prime examples.

Tools of DeFi: Smart contracts and DAppsSmart contracts

Smart contracts are contracts that run on blockchains. They are triggered once certain conditions between the buyer and seller are met. These conditions, or terms of an agreement between both parties, are written directly into the contract's code.

Smart contracts can help the unbanked population access financial services, otherwise unavailable to them via traditional finance. Smart contracts, for example, can be used for a loan agreement between two participants in microfinancing.

A borrower who does not qualify for a loan from a traditional institution can turn to digital ledger technology to access funds directly from multiple investors, with a smart contract defining the terms of the loan and monitoring it.

Small business owners in low-income areas can also eliminate their need for payment solutions provided by large banks and intermediaries. With the help of smart contracts, peer-to-peer payments and transactions can be made quickly and securely.

Decentralized apps (DApps)

Smart contracts are also used to build decentralized apps or DApps. While they are similar to normal apps in terms of function, the main difference with DApps is that they run on a peer-to-peer network (like blockchain).

DeFi DApps, for example, facilitate financial services like the lending and borrowing typically offered by centralized finance. They also facilitate peer-to-peer transactions and help the unbanked in low-income areas access financial services.

Kotani Pay, a project under the UNICEF Innovation Fund, allows Kenyans to convert crypto to fiat by dialing a shortcode (even if they do not have a smartphone). Another example is Leaf Wallet, built to give under-resourced communities and refugees access to digital financial services.

According to UNICEF, “Even without a personal banking history, institutional financial literacy, a passport, or a smartphone, Leaf helps people save, send, receive, exchange and pay money directly to and from their phone.”

How to get involved with DeFi?

If you're curious about the available opportunities through DeFi but don't know where to start, here are a few tips:

Get a crypto wallet

A crypto wallet is a digital repository where you can store your crypto coins to be used in DeFi protocols. You can choose any wallet, but make sure to keep your public and private keys. These will allow you to get back into your wallet.

MetaMask, Coinbase Wallet and Argent are popular choices. MetaMask, for example, is an Ethereum wallet that you fund with Ethereum. It also includes access to an exchange for trading DeFi coins. With a wallet, you can access various DeFi protocols that you can participate in.

Buy coins

The next step is buying coins for whatever DeFi protocol you intend to use. Since most DeFi protocols are on Ethereum, you're better off buying ETH or ERC-20. You can also use Bitcoin if you have it, but you'll need to first exchange it for an ETH version such as Wrapped BTC.

Trade digital assets

Now that you're ready to get started, you can either lend out your crypto, invest it or place it in a DEX.

You could lend out your cryptocurrency and become a “yield farmer,” which means that you'll be earning the governance tokens awarded to those who lend out their crypto.

Investing in DeFi projects is also an option, but consider this only if you're open to risk. You can invest in projects like Yearn Finance (YFI) or Aave.

You can also place your funds in a DEX (like Uniswap). DEXs allow you to earn fees from being a market maker.

However, keep in mind that the crypto space is full of risks as fraudsters and scammers still abound. Be careful when entering agreements, and make sure to do your due diligence when joining any pool or platform.

Look into stablecoins

Another option if you don't want to risk dealing with the price swings of underlying assets is TrueFi, which is a DeFi protocol for uncollateralized lending. It offers high returns on stablecoins and allows participants to earn high yields on such loans.

The future of DeFi

The rise of cryptocurrency and decentralized finance will most likely continue to shape financial services in the near future. Even now, the effects of DeFi and crypto becoming more mainstream are felt widely, and more and more traditional institutions are getting on board with the whole idea of decentralization — which could be good news for a lot of people, especially the unbanked. Diversified financial services made more accessible to the low-income population through DeFi are becoming a reality.

DeFi will likely give way to even more revolutionary opportunities for people, especially the low-income population, to gain financial freedom and independence. As such, security must also be continually studied and enhanced, and the issue of scalability addressed.

As for the general public, it always pays to be educated about the comings and goings in the crypto industry, especially if one hopes to make smart investments. Keeping updated with the latest market prices, news and trends is easier through our website, where you can access a lot of free resources, tips and how-tos about everything crypto.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!