An initial coin offering (ICO) is a way to raise capital for your project by selling blockchain-based digital assets.

Imagine you have a brilliant idea for a new blockchain startup. Perhaps you want to build the world's first decentralized computer on the blockchain, which can be used to create native digital assets and develop decentralized applications. Users of the network will transact using tokens, which are digital assets created using your blockchain (and the nifty decentralized applications you can build on top).

Seems like a pretty good idea. But, like any startup, you need to raise some capital first.

For a traditional startup, your options are to either: raise a seed round from private investors, pitch a venture capital fund (or a hundred of them, most likely), or attempt a crowdfunding using a crowdfunding platform.

With your blockchain startup, however, you have another option: Why not raise capital by selling the tokens the network will eventually use? As the network grows, meaning that the tokens become more in-demand, their value will rise and reward investors. This method of raising capital is an ICO.

Why ICOs are a popular way to raise capital

ICOs have a number of advantages:

Although the advantages are numerous, ICOs are no walk in the park. The crypto marketplace is extremely competitive and your project will face serious scrutiny from both regulators and the crypto community itself. This article will give you an overview of the work involved in pulling off a successful ICO.

Pre-sale: Everything needed before the launch

The very first question you need to answer is if an ICO is the right strategy to raise capital for your business.

The graveyard of failed ICOs is wide and deep — but the prospect of completing a huge funding round in a matter of months (or even days) can still tempt overzealous entrepreneurs to ignore the risks.

Not every project can successfully raise capital with an ICO. Firstly, it's important to understand that an ICO isn't just about raising capital. Before deciding on an ICO, you must know:

How the use of a token (and a blockchain) genuinely improves a business, product or service, beyond injecting a quick burst of capital in the short term;

How to generate a fair return on investment for token holders over the long term.

The most successful ICOs have a compelling use case for a blockchain and, as with any successful business, a product or service that people want.

There are thousands of tokens out there. Without a very convincing answer to these fundamental questions, investors are unlikely to take the risk of investing in businesses that are not well thought out.

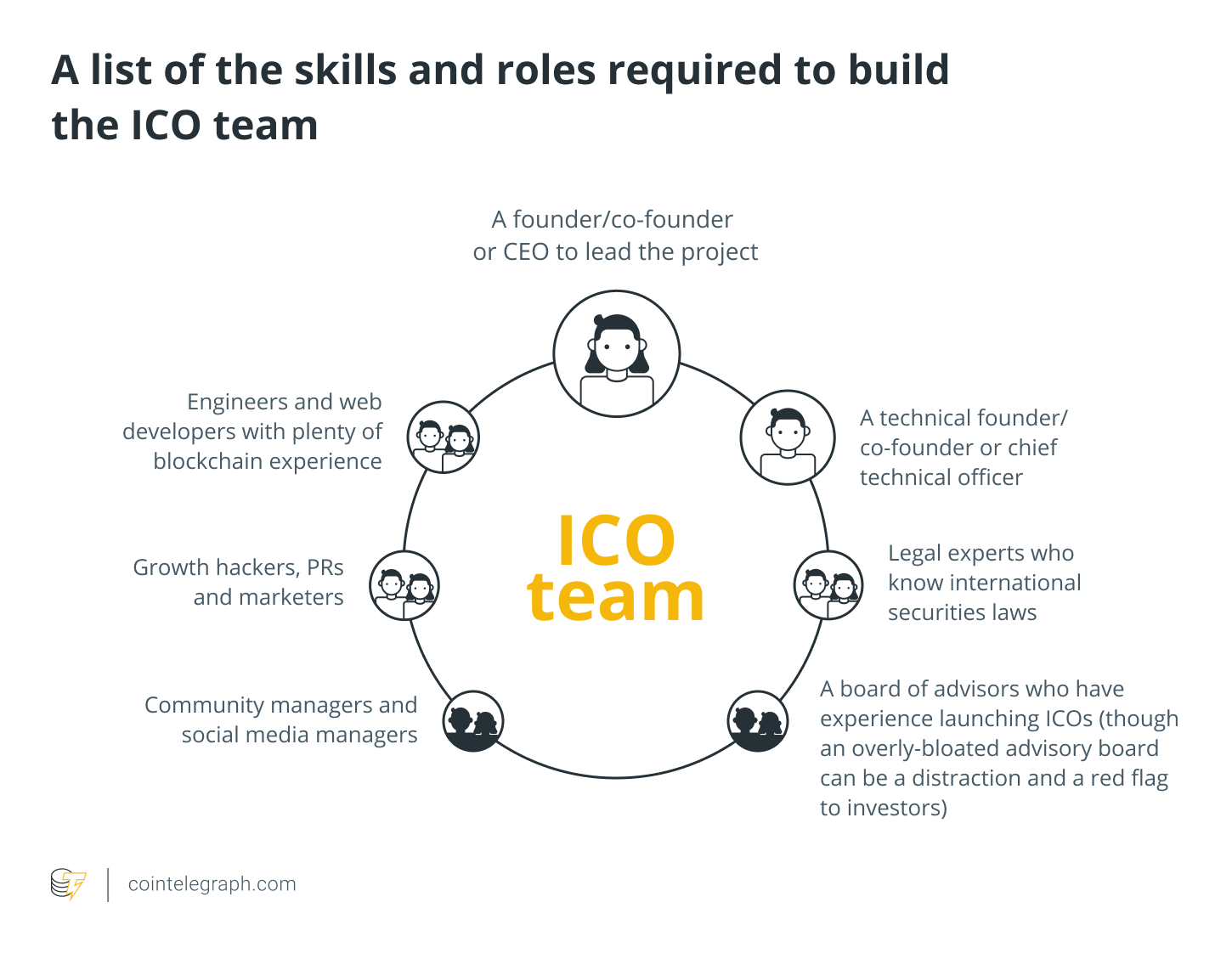

Build a team

An ICO is an enormous and multi-faceted project. You'll need an excellent team to be successful. In fact, the team behind an ICO is one of the most reliable indicators of whether it'll succeed or not, and investors will be paying attention to it.

Understand the law and choose the right jurisdiction

Regulators and lawmakers are becoming more sophisticated in their understanding of blockchain and crypto, but as a relatively new industry powered by completely new technology, it still exists in mostly a grey area of the law — this includes ICOs.

However, you should not interpret this as meaning that your ICO won't be subject to local laws and regulations. It actually means you definitely need legal expertise to clarify the exact legal nature of your token, how it might be regulated and what you'll need to do to stay compliant — particularly with regards to securities law which governs the issuance of financial instruments classed as securities (such as stocks, bonds and sometimes tokens), and Anti-Money Laundering (AML) laws, which intends to prevent money laundering.

The regulations that will apply to your ICO will vary according to the jurisdiction you're operating in. For example, tokens sold to residents of the United States could be subject to United States Securities and Exchange Commission (SEC) regulations and the Howey Test can be used to determine whether your token will be seen by the SEC as a security (and hence regulated by federal securities laws).

Some countries are known to have favorable legal frameworks for launching ICOs and crypto projects such as Singapore, Switzerland, Hong Kong, British Virgin Islands, Lichtenstein, the Cayman Islands, Bermuda, Cyprus, Malta and Gibraltar.

Choose (or build) the right technologies

It is not surprising that choosing the right technologies for your ICO will be fundamental to successful fundraising. The essential technologies that need to be in place are a blockchain, a smart contract, a token and an assortment of back-end web and security infrastructure.

Blockchain: Some projects choose to develop their own blockchain and use it to run their ICO, but the vast majority use established platforms such as Ethereum. Building a blockchain is a complex and time-consuming undertaking and is really only used in projects where a bespoken blockchain is necessary. While these blockchains may offer unique features and greater flexibility, they also require more time and more expertise.

Smart contract: A smart contract is the engine of your ICO. It handles incoming token purchases, enables token holders to transfer and sell tokens, connects to your token wallet and more. It's critical, therefore, that you properly audit your smart contract to ensure that it is completely secure and functional, as, for example, hackers will be looking for exploits in the smart contract to steal money from you and your investors.

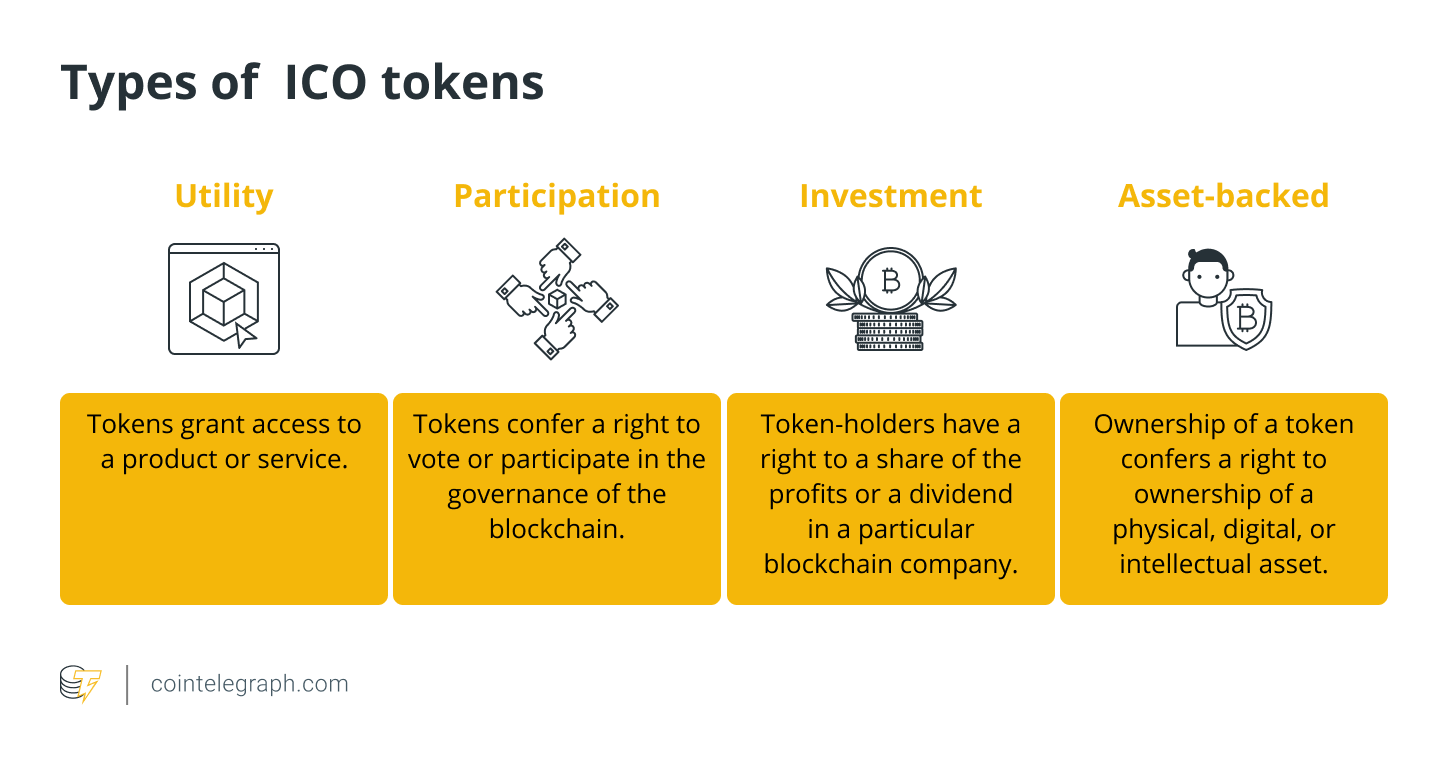

Tokens: Since tokens are code, they can be programmed with different features. Tokens can be categorized as utility, participation, investment, or asset-backed. Each type can be bound by its own legal requirements and it's therefore very important to be clear on the status of your token. Here are some explanations on the different types of tokens:

Infrastructure: On top of the blockchain-specific technologies which are essential to your ICO, you'll also need servers to manage your website traffic and onboard users. This is typically with automatic Know Your Customer (KYC) services or manual verification.

Security: While blockchains are highly secure, smart contracts and websites can be exploited by hackers, and ICOs can be a “honey pot” for scammers and hackers. You will be vulnerable to the domain name and social phishing, personal data breaches, smart contract hacks and distributed denial-of-service (DDoS) attacks. Having excellent security in place will protect and reassure investors about your project. Having a professionally audited smart contract, high-quality reliable hosting service (with DDoS protection) and domain monitoring for phishing, as well as buying up similar domain names yourself will all help secure your project and your investors.

Design your tokenomics

In general, you want to find a balance between the supply and the price of your token for your ICO. If supply is too high, then the price per token will be diluted and low, but if the supply is too low then there might not be enough tokens to satisfy your investor base, or investors might be put off by the high price of the token. These factors are known as the tokenomics of your ICO.

The tokenomics of your project should support the nature of your product or service, as well as the price of your token. Two factors that are necessary to think about are the allocation and distribution of tokens and the supply of tokens.

Allocation and distribution: There are many decisions you will need to make to decide how to allocate and distribute the token. One of the first is whether it would be better to launch a private or public ICO, or use both. A private ICO offers pre-mined tokens to a limited and selected group of investors, often in a pre-sale event ahead of a public ICO. Public ICOs allow almost anyone with a crypto wallet to invest in a token and are sometimes referred to as token crowdfunding.

A balance has to be struck here. If employees and early investors control too high a percentage of the tokens, the price of the token can be severely impacted if one of them sells. Many ICOs will include lock-up agreements to help stabilize the price over the short to medium term. If too much of the supply of your token is held by whales (anyone owning a significant percentage of the tokens), then it's also a red flag for retail investors who will be wary of getting dumped on.

Supply of tokens: Your token will have a maximum supply (the maximum number of tokens that can ever be created/mined), a total supply (the number of tokens that exist at present) and a circulating supply (the number of tokens currently in circulation i.e., not locked up or burned). The value of your token will be determined in part by the supply, as well as the promise of your project.

You can design the supply of your token to be inflationary or deflationary, depending on the nature of your project. Inflationary tokens do not have a maximum supply (new tokens can always be created) but deflationary tokens such as Bitcoin (BTC) do have a capped maximum supply.

An inflationary model can lead to the devaluation of your token over time, but it also encourages tokenholders to use their tokens. Using a deflationary model helps to increase, or at least maintain, the value of each token as demand increases, but can also lead to tokenholders hoarding their tokens instead of using them. You will have to decide which model is right for your project.

Choose your token sale model

After deciding on the tokenomics of your project, you'll need to decide how to manage the sale of the tokens. The token sale model needs to balance simplicity with as much diversity as is necessary to entice and reward a mix of investors.

Soft, hard and hidden Caps: The soft cap is the minimum amount your ICO must raise (either in the number of tokens sold or the amount raised) and the hard cap is the maximum amount that the ICO must raise before it ends. The caps are set before the ICO begins. Hidden Caps can be hard or soft, but investors are not able to know the capitalization is until the allocation is finalized.

Uncapped or capped with fixed rates: You can create a fixed price for the tokens at an early stage of the ICO usually at a discounted price, moving them to another fixed price at a later stage. It motivates investors to buy in early.

Dutch auction and reverse Dutch auction: In a Dutch Auction, a smart contract is used to calculate the price of the token only after all bids are received, with the highest bids being prioritized. Reverse Dutch Auctions start with a high token price and cap, which then declines each day the sale runs or for every block that is mined. The sale ends once the cap is reached.

Collect and return (C&R): With C&R, the cap is fixed but with some flexibility. A smart contract collects contributions that exceed the predetermined fixed cap and then adjusts the final allocations of tokens by ratio, with any difference returned to owners.

Dynamic Ceiling: Instead of making the entire cap available to investors at once, dynamic ceiling ICOs create a series of hard caps which raise the capital in stages. This type of ICO has the advantage of preventing whales from buying up the entire allocation in one go, which could block smaller investors from buying in.

Create your product roadmap

Your ICO is a means to an end. Your investors will want to know why you're raising this capital, what it's going to be used for and where your company is headed. A detailed product roadmap is necessary to convince investors that your business is legitimate and likely to succeed.

The roadmap should contain:

A well-articulated vision of your project — hiring a copywriter can help you craft this.

A series of SMART (specific, measurable, actionable, realistic, time-bound) milestones and goals.

Write your white paper

A white paper is a pitch for your ICO. It will be the primary reading material for investors doing their due diligence on your project. This white paper will be vital in convincing investors that your project is legitimate and credible, and you'll ideally want it in place before building your community and reaching out to investors, whether you're doing a private or public ICO.

Your white paper should include everything mentioned above, from your market research and your team to your technology, tokenomics and product roadmap. Don't skimp on copywriters and graphic designers — the better your white paper looks, the better your project looks.

If you want a complete breakdown of how to write and structure your white paper, read the Cointelegraph guide on everything to know about white papers.

Getting ready for launchCreate your website and brand

Investors will judge a project by the quality of your website. Hire the best web developers and designers you can afford and don't cut corners. If your project is international and you want to attract international investors, you should consider hiring professional translators to translate your website into the native languages of the jurisdictions you want to target.

Before your ICO launches, your website should also have a token sale landing page. This page should offer a snapshot of your project and its biggest selling points, as well as have your white paper clearly signposted. A well-executed landing page can be a powerful lead for your ICO.

Build your community

Community is everything in crypto. A dedicated, loyal and enthusiastic community will be a game-changer in marketing your project and ICO. You'll help to build your community with a serious public relations (PR) and marketing push.

In general, you'll be best served by PR and marketing agencies specializing in ICOs and crypto. The cryptoverse is unique, and most corporate and traditional practitioners won't have a sophisticated enough understanding of the ecosystem, investors, or media.

PR: A great PR team has its finger on the pulse of the crypto media (and potentially tech and national media) and excellent proven contacts within it. PRs can get you featured in thought leadership pieces in top-tier crypto-publications, position you as an expert to be quoted in significant trending stories, write press releases that land and, most importantly, know how to pitch your specific project to journalists. They can also get founders featured on podcasts and interviewed on YouTube channels hosted by famous crypto personalities.

Community groups: You want to ensure that you're constantly engaged with your community before, during and after your ICO. A community manager will organize and build your Slack, Telegram and Discord channels, all while managing your inquisitive and enthusiastic investors. Be active on forums such as Reddit and BitcoinTalk, write your own Medium blog and frequently update your GitHub.

Social media: An engaged presence on the most popular social media channels is essential to keep investors and potential investors informed. Hire a social media manager who can give you an entertaining and engaging presence.

Pay-to-play: Many mainstream social media platforms banned ICO-related advertising in 2018 (although they have since relaxed some of these bans) but you can still run paid ads in crypto publications and other media. It's worth experimenting with various types of advertising and pricing models (e.g., impressions vs direct response) at different stages of the token sale.

Influencer marketing: Getting a noteworthy celebrity on board can push the recognition and trust in your project to new heights. Ensure that you do a lot of due diligence and choose the right influencers — you'll be tying your reputation to theirs.

Bounty programs: You can generate interest in your project pre-ICO by putting bounties on reporting bugs, promoting your project, maintaining forums and other fan projects and other tasks. They are a great way to encourage crypto-savvy individuals to engage with the details of your project.

ICO calendars: You'll want to ensure your ICO is listed on all of the most popular ICO calendars, such as Cointelegraph's ICO calendar.

Rating agencies: Specialist rating platforms will rate and audit your ICO. They aren't cheap but can offer an impressive stamp of quality and credibility.

List on crypto exchanges

It's no good to have a brilliant project, a token that everyone wants to buy, and absolutely nowhere to sell it. It's critical to have the token listed on exchanges ahead of your ICO date. Listing on high-quality, secure and legally compliant crypto exchanges will also help to promote your ICO organically.

Exchanges all have their own requirements for allowing you to list, often depending on the nature of your token and business. Some of these requirements will be universal such as having an audited smart contract.

Because exchanges make money by charging fees on trades, it's in their interest to list in-demand new tokens. If you have a sizable community and can demonstrate high demand for your token, you shouldn't have a problem finding an exchange to list you. The application and listing process usually takes 1-2 months, so factor that into your timeline and overall ICO roadmap.

Post-sale: You've launched. Now what?

Remember what we said earlier: Your ICO is a means to an end. If you've raised the capital you needed to, congratulations. Now, it's time for you to stay engaged with your community and to deliver on what you promised in your white paper.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!